Inflation is under control.

Nothing to see here!

The Fed will go back to lowering rates again by March.

Sometimes I feel like I’m living in a parallel universe. And by “sometimes,” I mean every time I hear the monthly inflation report mentioned in the media.

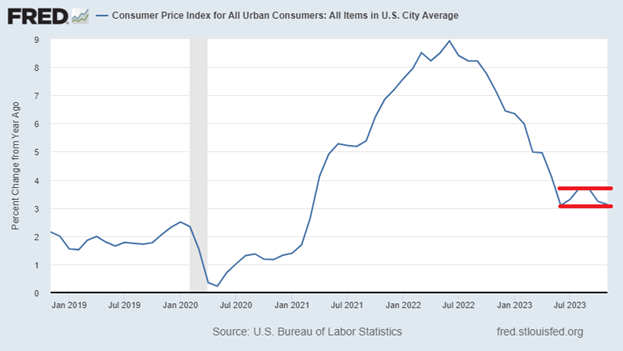

In case you missed it, the November consumer price inflation (CPI) numbers came out this week. The headline number was 3.1%, which was in line with most expectations.

I lost track of the number of headlines I read this week that indicated “inflation was continuing to slow.”

But is it?

CPI has been bouncing in a range of 3% to 4% since June, as I’ve highlighted by two parallel lines in the chart below. That doesn’t look like falling inflation to me. It looks a lot like 3% inflation becoming endemic.

Apart from the obvious – that 3.1% is still 50% higher than the Fed’s stated goal of 2% – the headline number doesn’t tell us much anyway. We must drill down to get any meaningful information here.

So, let’s do that…

The Supply Chain Is Mending

The biggest contributing factor to inflation “falling” to 3.1% was declining energy prices.

As I wrote last week, American Big Oil is back. U.S. crude production just hit 13.2 million barrels per day, pushing past its old pre-pandemic highs. America is flooding the energy markets with new supply. That helped push November energy prices down a full 5.4% since last November.

Overall inflation in goods is moderating too.

For example, inflation in clothing and new cars was a little more than 1% each last month. The prices of floor coverings, linens, furniture, appliances, dishes, flatware, and a host of other commonly bought items, actually fell in November. Rather than inflation, we saw some deflation.

That’s all great and it shows that we’re finally righting the supply-chain snarl of the past several years.

There’s just one small problem.

The Problem Isn’t Monetary

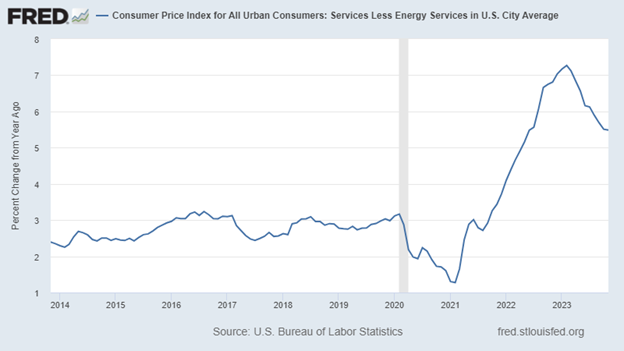

The United States is largely a service-based economy and has been for decades. Goods accounted for about 23% of the economy last year, whereas services accounted for nearly double that amount at 45%.

And inflation in the services sector is still clipping along at 5.5%, as you can see in the chart below.

Here’s where it gets tricky for the Fed: The problem isn’t monetary. It’s demographic.

The biggest cost in the service industry is the workforce. When workers are in short supply, you must pay them more to get or keep them… which means you must raise your prices to maintain profitability.

The size of the American working-age population has been flat since about 2016, as Millennials and Gen Z entering the workforce have just barely replaced Baby Boomers aging out.

But it’s also not just a matter of body count. The Boomers leaving are experienced and highly productive, whereas the fresh blood coming into the workforce is still learning on the job.

Fed Chair Jerome Powell can tinker with interest rates to reduce demand. But he can’t waive his magic wand and make new workers materialize out of the ether.

Demographics is a problem the Fed can’t address. But it’s the reason we take forecasts of inflation falling with a large grain of salt.

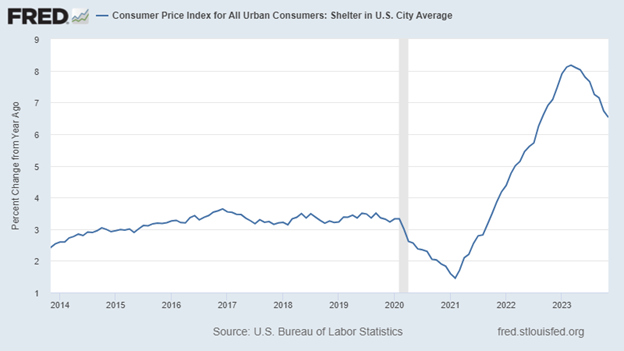

Rent Inflation Is Still Brutal

Apart from services in general, the cost of shelter is also still rising at a punishing rate. As you can see in the chart, rent inflation exploded higher two years ago and remains over 6.5% as of November.

Last week, my friend Michael Gayed had a lot to say about housing. He pointed out that new home prices were down 17% over the past year… even while the inventory of existing homes continues to sink. Existing home sales are down by 42% from their highs last year. The market is stuck in a deep freeze.

Perhaps the only thing keeping the housing market from collapsing entirely is that buying a home, even at today’s unaffordable rates, might still be less bad than watching your rent rise by 6.5% per year.

I don’t care what the headlines say. To the extent that inflation is under control at all – and I’m sorry, but at a 3.1% clip that is debatable – it’s only because energy and manufactured goods prices are moderating.

Services and housing? They’re much bigger and tougher nuts to crack.

The only way to get ahead of inflation in the services sector is via investment in automation, artificial intelligence, and other labor-saving tools. That’s happening, of course, and is a source of great fear for many who don’t understand the value of exponential progress… or people’s resilience. Hence the increasing clamor for government regulation and oversight to prevent AI from turning into Skynet (a la Terminator).

Here at The Freeport Society, we don’t succumb to mass hysteria. We don’t fear progress… we embrace it. That’s why I’ve highlighted five stocks to invest in for 2024. Check it out here.

To life, liberty, and the pursuit of wealth…