Editor’s Note: Charles is globe trotting for the next two weeks. Today, he and his family are in Amsterdam. Then it’s off to Florence and Rome.

So, today, we’re sharing with you an insight from colleague Andy Swan – the founder of LikeFolio.

It analyzes millions of data points daily to uncover market trends and opportunities hidden in social media and web data.

And the scale it operates on is mind-boggling.

In one day, LikeFolio’s Data Engine processed 1,230,030 items – from Reddit alone. That’s nearly 30 million data points a month… from just one of its data sources.

By tracking these trends, they can predict stock moves before most folks on Wall Street even see them coming.

It’s pointed Andy’s subscribers to gains of 445% and 238% in Coinbase (COIN)… 145% in Stride (LRN)… and 164% in Zoom (ZM) – all in less than two years.

And LikeFolio’s data analysis works for crypto, too.

Today, Andy walks us through the opportunities LikeFolio is pointing to in Bitcoin. As you’ll see, his data shows that it’s not too late to join the crypto party.

And don’t worry if you don’t fancy owning Bitcoin directly. Below, Andy shows how you can profit from crypto’s surge by way of one of the most innovative stocks in today’s market.

It’s Not Too Late to Join the Crypto Party

By Andy Swan, Founder, LikeFolio

In 1471, an English cloth trader called William Caxton encountered Gutenberg’s revolutionary printing press while on a trip to Cologne, Germany.

It was a machine destined to change the world.

Gutenberg’s press could copy books faster than any monk’s hand. Caxton was a convert. He learned how to print and secretly brought this breakthrough new technology back to England.

By 1476, he had set up England’s first press, flooding the market with books printed in English.

Before this invention, elites tightly controlled knowledge.

Books were rare and costly, each slowly copied by hand. But Caxton’s press tore down these barriers. Ordinary folks could finally access knowledge without needing permission from kings or priests.

Authorities panicked.

They saw the press as dangerous – a tool for spreading uncontrollable ideas.

Governments and the Church responded fiercely. England issued strict decrees, banning unauthorized printing and censoring books to regain control, and so did France.

Scribes and poets denounced the invention, and in some cases, called on their leaders to remove presses from their cities entirely.

Filippo de Strata, a Venetian monk, called the printing press the “plague which is doing away with the laws of decency.” These people feared widespread corruption. And they feared for their jobs.

But the genie was out of the bottle. And nobody could put it back inside.

Printing spread rapidly, unstoppable by any decree. Eventually, rulers and bishops realized their mistake. Unable to eliminate the technology, they tried to control it – printing their own approved books, decrees, and Bibles.

They were too late.

The monopoly on knowledge was shattered.

Information flowed freely, empowering ordinary people.

As literacy surged, the authority of kings and priests diminished. Power decentralized, spreading into the hands of millions.

And thanks to Bitcoin, it’s happening again.

Turning Tide

Today, that history is echoing once again with another groundbreaking invention that was initially mocked and dismissed.

Financial leaders ridiculed it, calling it a scam or a toy for criminals.

Banks feared losing control, and so warned against it.

Governments labeled it dangerous, associating it with crime and chaos.

Still, this technology refused to fade. Instead, it grew stronger, moving beyond the reach of skeptics.

Regulators shifted from mocking to attacking. They issued threats, warnings, and calls for bans.

In 2021, China banned its use entirely, sending prices plunging overnight. Bank CEOs openly declared traders foolish for even touching it.

But the tide turned.

Those critics began pivoting. Institutions realized they couldn’t stop it and decided to control it instead.

Banks and asset managers began developing their own systems to embrace this disruptive innovation.

Financial giants now cautiously offer sanitized versions, packaging it safely for mainstream investors.

But like the printing press, this technology resists control. Its power lies in decentralization.

Value, like information before it, flows freely without permission from governments or banks.

Money crosses borders instantly, weightlessly, at the speed of light… secured by math rather than control.

Those who grasp this truth don’t wait for approval. Like Caxton quietly setting up his press, they build patiently, confident their moment will come.

The old gatekeepers may attempt to control this new revolution, but like kings and priests centuries ago, they will never regain their monopoly.

Once again, power shifts from the few to the many. And once again, those who embrace change will shape the future.

They will build.

They will wait.

They will triumph.

And after today, my hope is that YOU will count yourself among them.

You Haven’t Missed the Bitcoin Boat – Yet

Since Bitcoin (BTC) came on the scene in 2008, it’s gone from trading for a fraction of a cent to topping $123,000 – minting more new millionaires in our lifetimes than any other asset we can think of.

My brother Landon was an early adopter – nabbing something like 15 (whole) bitcoins back in May 2013, when you could get it for around $100 apiece. Oh, how times have changed:

The price of BTC has multiplied 1,000x. It’s become one of the greatest wealth creation vehicles of all time. And right now, it’s trading near all-time highs.

But guess what?

We’re still buying.

Because we know there’s more upside to come.

Retail Traders Are Back, Baby

For years, Bitcoin’s rallies were fueled by retail hype and ended in sharp corrections.

This time is different.

Institutions are driving demand, ETFs are absorbing supply, companies are adding Bitcoin to their balance sheets, long-term holders aren’t selling… and, until recently, the retail crowd simply wasn’t interested.

That setup points to a market driven by conviction, not FOMO.

But this week, LikeFolio detected a notable shift in Main Street behavior.

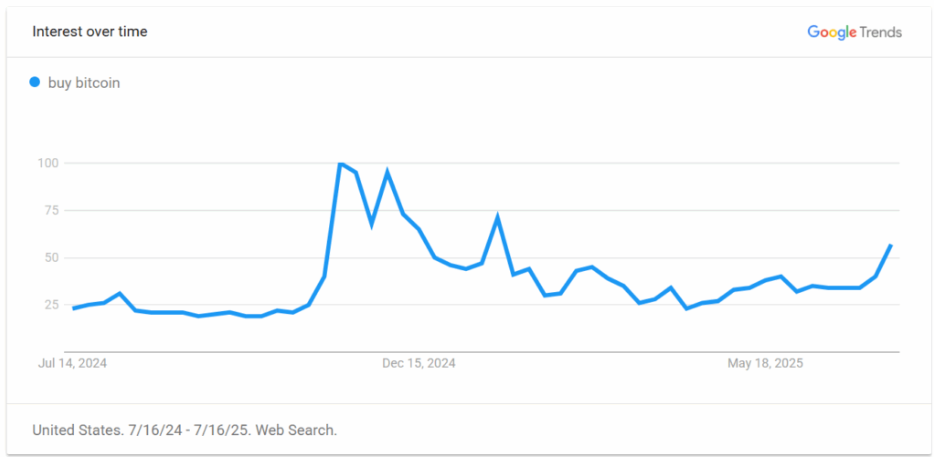

Web and app traffic to Bitcoin-enabled platforms such as Coinbase Global (COIN) and Robinhood Markets (HOOD) are now climbing. And Bitcoin search volume is suddenly up more than double digits, a stark change from levels recorded earlier this month:

The ETF-driven rally has reignited retail interest. FOMO is back. And it could trigger a fresh wave of Bitcoin profits.

Many traders left on the sidelines may feel like they’ve missed the boat. You haven’t.

Better yet, in 2025, you have more options than ever to capitalize on Bitcoin’s momentum without ever leaving your trusty brokerage account.

Alternative Bitcoin Plays for the Crypto Skeptics

While the best way to profit from Bitcoin is to buy the cryptocurrency itself, not everyone is comfortable with going onto a crypto exchange… buying Bitcoin… and then storing it in a digital wallet, like us “crypto purists” do.

And that’s OK.

These are a few of the best Bitcoin proxy plays on the market today…

Bitcoin Alternative No. 1: ETFs

The purest way to invest in Bitcoin without actually owning Bitcoin is through the Bitcoin ETFs. They trade like a stock on an exchange, so you can buy them through your regular broker.

Bitcoin ETFs are set up to directly mimic Bitcoin’s price on a near tick-by-tick basis. They do that by owning and storing bitcoins on your behalf. If you choose right, you pay a small management fee – usually around 0.2% to 0.3% a year.

You get Bitcoin exposure in your brokerage account without having to buy bitcoins directly on a crypto exchange and store them there or self-custody them in a digital wallet.

Right now, the most popular Bitcoin ETF is BlackRock’s iShares Bitcoin Trust ETF (IBIT).

IBIT recently surpassed $80 billion in assets under management (AUM), earning it the title of the fastest-growing ETF in history. This one tops our list.

Fidelity also has a good Bitcoin ETF, the Fidelity Wise Origin Bitcoin Fund (FBTC), and the annual fees are comparable at about 0.25%. Two good options – but not your only ones.

Bitcoin Alternative No. 2: Miners

Another way to get exposure to Bitcoin is through Bitcoin “mining” stocks. These companies validate transactions on the Bitcoin network and earn newly minted bitcoins as a reward.

Right now, that “block reward” is 3.125 bitcoins – but that amount halves roughly every four years until Bitcoin reaches its hard cap of 21 million bitcoins (that won’t happen until the year 2140). Once that cap is reached, Bitcoin miners earn fees for validating transactions.

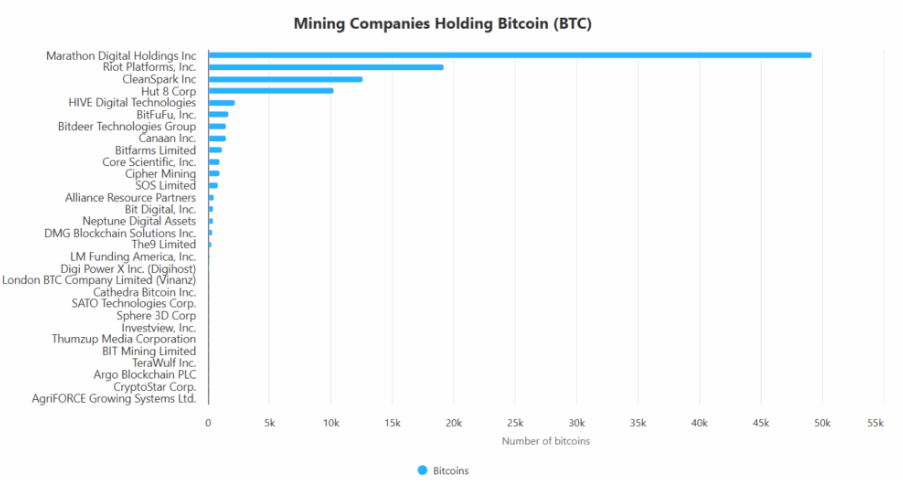

There are currently five publicly listed Bitcoin miners in the U.S., each one competing to earn block rewards. It’s an extraordinarily competitive endeavor. But one company has the clear lead – and not just in our eyes.

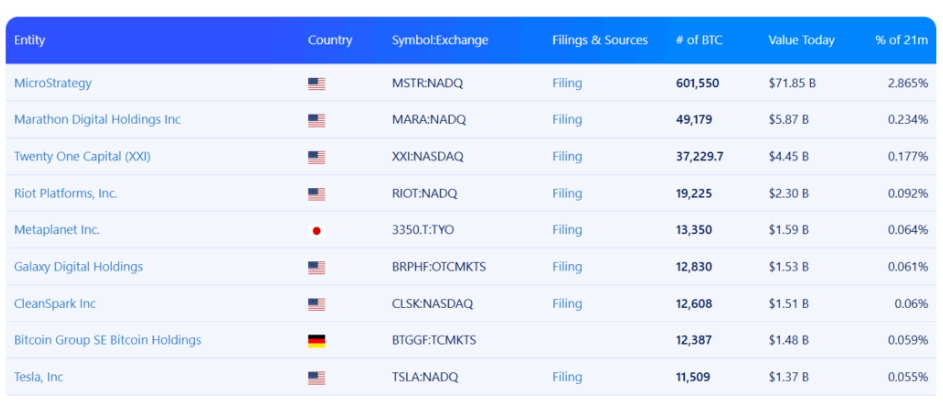

Marathon Digital Holdings (MARA) holds 49,940 BTC, as of June, putting it in first place among miners and second among all publicly traded companies with Bitcoin on their balance sheets.

Marathon maintains this lead because unlike other miners, it doesn’t mine bitcoins and sell them to cover its costs and turn a profit. It “stacks” – or accumulates the bitcoins it mines – by adding them to its balance sheet, looking for price appreciation rather than instant revenue.

A word of caution: Don’t expect these mining stocks to track Bitcoin’s performance like the ETFs do. Bitcoin is up more than 80% over the last year. MARA is down nearly 30%.

But if you’re bullish on Bitcoin and somewhat bullish on mining, this one is worth a closer look.

Bitcoin Alternative No. 3: Holders

Some of the largest Bitcoin holders in the world are publicly traded companies hiding in plain sight.

Michael Saylor’s software company, Strategy (MSTR), owns the most of any of them – with nearly 3% of all bitcoins in existence on its balance sheet.

Think of MSTR as a leverage play on Bitcoin.

The company’s entire purpose for existing over the last five years has been to increase the number of bitcoins that it holds per share.

Strategy issues new shares and sells them to fund its Bitcoin buying. It also issues convertible bonds and debt to buy Bitcoin. If you like that approach, MSTR makes a compelling bet. But it’s a speculative one.

I can do you one better.

The Top Proxy Play Hiding in Plain Sight

What many investors don’t realize is that Tesla (TSLA) is among those top bitcoin holders, too. The company owns over 11,500 bitcoin – a haul worth more than $1.3 billion at these levels, topping even Coinbase.

Tesla’s Bitcoin stake boosted its net income by around $600 million in 2024. That’s because new accounting standards allowed unrealized crypto gains to be recorded on the income statement.

Tesla didn’t sell. It hasn’t traded around the position. It’s simply held it on the books.

This is what makes Tesla so compelling.

Unlike miners, brokers, or MSTR, Tesla isn’t priced as a crypto play. Its multiple is driven by EV margins, Full Self Driving (FSD) adoption, and long-term energy strategy.

Bitcoin is a sleeper on the balance sheet, and that’s exactly the kind of asymmetric setup that tends to work when the market starts rotating into second-wave beneficiaries.

And, as you saw earlier, that rotation in consumer behavior is happening right now.

The Bottom Line: It’s Not Too Late to Join the Party

Each of the ETFs, miners, and holders we covered today still have room to run.

But savvy investors should be asking themselves: What else is still underpriced?

That’s where Tesla becomes the standout among Bitcoin proxy plays:

- It gives you Bitcoin upside without being dependent on block rewards or trading volumes.

- It gives you earnings leverage from crypto, EVs, autonomy, and AI.

- And it gives you the kind of mispricing edge that only lasts until the Street catches on.

For traders looking to add exposure to Bitcoin after the first wave, we believe TSLA offers one of the most compelling asymmetric setups left on the board.

Until next time,

Andy Swan

Co-Founder, LikeFolio