My 11-year-old son asked me that this morning at the breakfast table. “Is that a science thing? Like a black hole?”

I was impressed that Ian was news aware enough to know that ”Jackson Hole” was a thing. I don’t know that I would have been at 11.

But no, son. Jackson Hole is not a science thing. Science would imply that there were fundamental laws of the universe involved and not merely the whims of central bankers.

Although…

Perhaps he’s onto something comparing it to a black hole. Just as black holes are so dense that not even light can escape their gravitational pull, the ladies and gentlemen who run the Federal Reserve also know a thing or two about being dense.

These are the people who ensured us inflation was “transitory” before panicking and jacking interest rates to multi-decade highs.

These are the people who have lurched us from one crisis to the next for the past quarter century.

And, alas, these are the people currently deciding our fates.

And as I write this, the Federal Reserve’s annual shindig in Jackson Hole, Wyoming, is wrapping up. In the world of central bankers and economists, this is the equivalent of the Met Gala. Anyone who’s anyone in the world of technocratic tinkerers was there.

I wish we lived in a world in which this didn’t matter.

Who knows, maybe someday – when these people finally make a mess so big that it can’t be fixed with rate cuts and quantitative easing – we’ll do away with the ludicrous notion that a merry band of academics can set interest rates better than the market.

But that’s not today.

Regrettably, these people still matter… and still have a massively outsized influence on our financial lives. So you can bet that every analyst on Wall Street parsed every word uttered by Powell and his peers these past few days for clues as to what comes next.

Specifically, they’re looking for any sort of confirmation that the Fed will indeed cut rates at its September 17-18 meeting. And yes, Powell all but promised that he would. But he left unsaid the size of the cut or the number of other cuts (if any) we should expect later this year.

It may seem obvious, but let’s consider why…

Why This Matters

Over the long term, earnings and the multiples that investors are willing to pay on those earnings are what drive stock market performance.

The key words there are “over the long term.”

In the shorter term, “money flows” – big institutions like investment banks and pension funds buying or selling large amounts of shares – move stock prices. And in those cases, the Fed is the lynchpin. When the Fed is flooding the markets with liquidity, a lot of that money ends up flowing into the stock market.

That was certainly the case in the FOMO market of 2020-’21 and during the “everything bubble” of 2009-’19. The Fed created trillions of dollars in liquidity in the name of juicing the economy, with a lot of it flooding into the Wall Street casino.

Stocks trade at the premium prices they do today on the assumption that the Fed is about to flood the market with fresh liquidity.

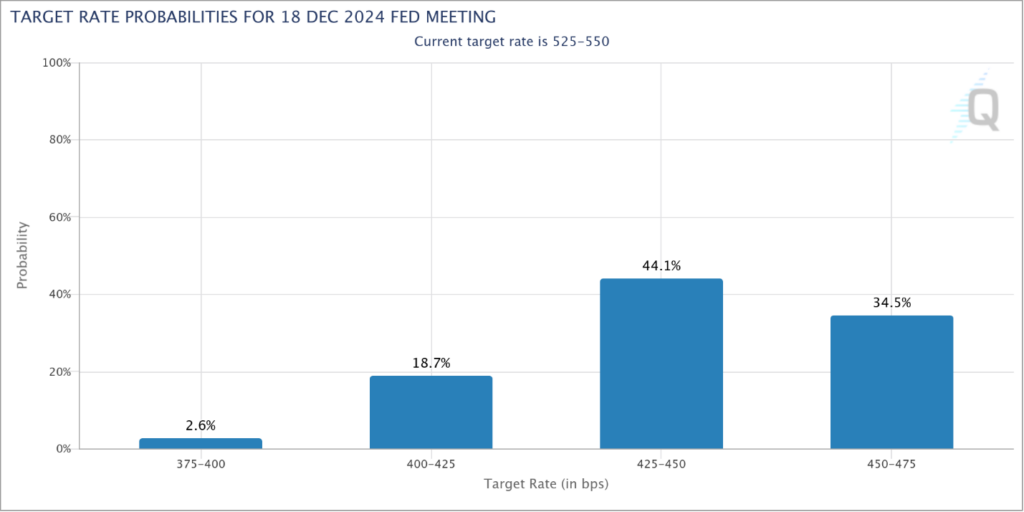

Take a look at what the futures markets are pricing in for the December 18 Fed meeting, their last meeting of the year. Traders are assigning 100% odds that the Fed lowers rates by at least 0.75% (see below). They’re pricing in a 65% chance that the Fed cuts by 1% or more. There are a bunch of traders pricing in cuts of 1.25% to 1.5% as well.

I struggle to understand where these traders get these ideas.

Powell may be terrible at his job, but he’s nothing if not transparent. He likes to telegraph his moves far in advance to avoid surprises.

All of his comments leading to today suggest that the Fed might lower rates by 0.25% to 0.5% before year’s end. The last thing Powell wants to do is cut too quickly and reignite inflation. That would be a nightmare for him because he’d then have to do an about-face and raise rates again.

By the way, as far back as April, I was that lone voice in the wilderness saying that the Fed would go slow in cutting rates – and that we might get a 0.25% cut after the election… if we were lucky. It’s looking like the Fed might cut a little faster than I expected… but I still think I’m right on the amount. I don’t see massive cuts this calendar year.

But, if we do see what the traders are predicting, it’s going to be because something goes terribly wrong – probably the economy sliding into recession – and the Fed panics, slashing rates after the fact.

We’ll find out soon enough.

We’ve already had our share of surprises in 2024, and I expect a major new one, particularly regarding the upcoming election. I believe betting markets are getting it wrong on their election predictions as well.

In fact, I’m expecting a major election shock ahead of us, all the more now after the Democratic Party wrapped up its convention this week. I’ll talk about this more next week, so stay tuned.

To life, liberty, and the pursuit of wealth.