You’re killing me, Smalls.

I’ve been working my way through the catalog of classic sports movies with my sons, and we recently watched that distinctly American coming-of-age gem The Sandlot.

The last time I saw it was in the theaters during its original 1993 release, so there was a lot I didn’t remember. I did, of course, remember Benny stealing home plate at the end. I remembered the neighbor’s dog the boys were terrified of.

And I remembered the baseball autographed by Babe Ruth.. and how the dog chewed it up.

Even as a 16-year-old watching the movie for the first time, that was a punch to the gut. That was a baseball signed by Babe Ruth. A mint-condition ball signed by Ruth can easily trade for $30,000 or more. A mint-condition baseball signed by Ruth’s entire 1927 Yankees team could be worth more than the first house I bought.

Alas, I don’t have any priceless sports memorabilia stuffed away in my closet. Believe me, I’ve looked.

But as John Pangere explains, it might be worth your time to look through your own closet or attic. The sports memorabilia business is booming, and this is a market where a little expertise still goes a long way.

It’s also an excellent candidate for alternative investments, which are particularly important to have in your portfolio as we navigate this Age of Chaos.

Before we get to John’s letter, I want to take a minute to welcome him to The Freeport Society family. Today, John and his Freeport Strategic Opportunities join our suite of investing and trading services. (Members of John’s Rogue Strategic Trader can log in to his new home at Freeport Strategic Opportunities by going here.)

John is a former investment banker, having worked on late-stage venture deals and with early-stage startups, raising tens of millions of dollars for companies like Twitter and Bloom Energy before they went public. He has successfully traded currencies, futures, and options and invested in stocks and real estate for years.

And as of today, he’s the man behind Freeport Strategic Opportunities, where he continues his mission to deliver outsized gains with the least amount of risk by tapping into one of Warren Buffett’s favorite wealth-creation vehicles – stock warrants.

I’ll have more on how to join him at Freeport Strategic Opportunities soon.

Until then… look forward to having John show up in your Freeport Navigator feed at least a few times a month… and I hope you do as well.

Over to you, John!

To life, liberty, and the pursuit of wealth,

Charles Sizemore

There’s Treasure in Your Closet… and Your Portfolio

By John Pangere, Senior Analyst, Rogue Strategic Trader

Caitlin Clark is 22 years old… and may be the only women’s basketball player you’ve heard of.

But she won’t be the last.

During her time at the University of Iowa, Clark elevated women’s college basketball to a whole new level with her scoring prowess and playmaking abilities.

She ended her college career as the all-time leading scorer in NCAA Women’s Basketball… and the all-time leading scorer in all of NCAA basketball. Even trouncing the legendary “Pistol” Pete Maravich for the title.

Now she’s doing the same in the WNBA.

As the No. 1 pick in the draft, Clark plays for the Indiana Fever. Virtually every game she plays sells out. Fans want to see her put up another triple-double (that’s when a player delivers double digits in three different statistical categories during a game).

For the first time ever, people watch the game because it’s good.

But it’s not just on the court that she’s popular. She also holds the attention of collectors… myself included.

The Hobby

I’ve been a collector since I was a kid. I started with sports cards, which I still collect and trade today.

It’s fun and a lot like investing. It’s even a lot like speculating. But it’s evolved to become its own asset class… an alternative investment much like collecting art.

And in the current world of chaotic financial markets – like we saw last week – alternative investments may become more important as a way to store and grow your wealth.

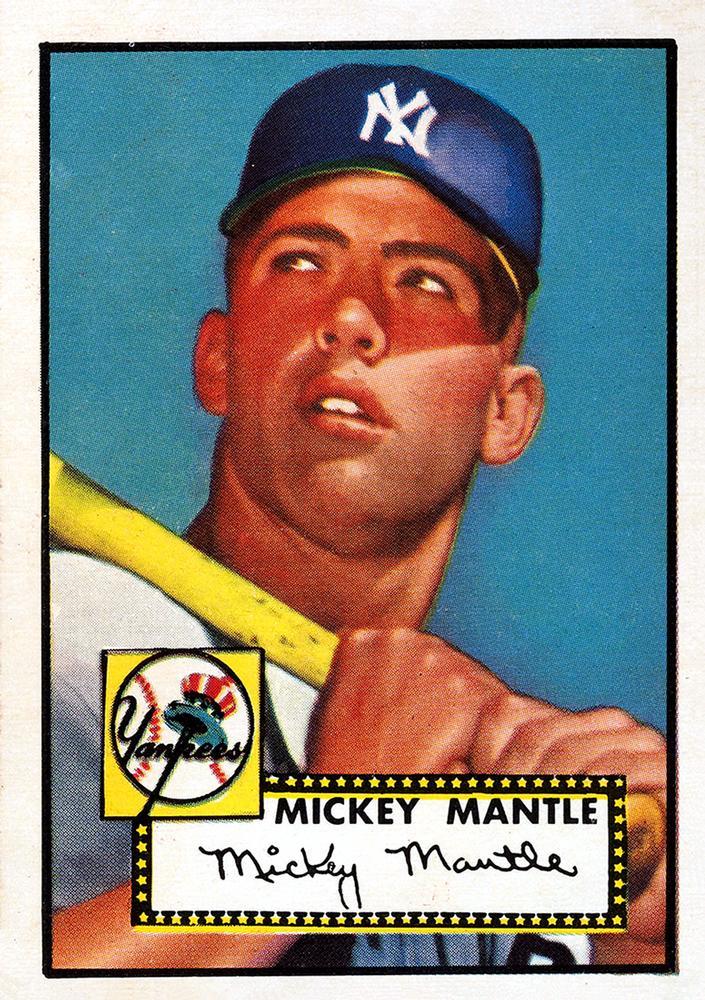

In sports cards in particular, there are long-term investments, like the 1952 Topps Mickey Mantle rookie card.

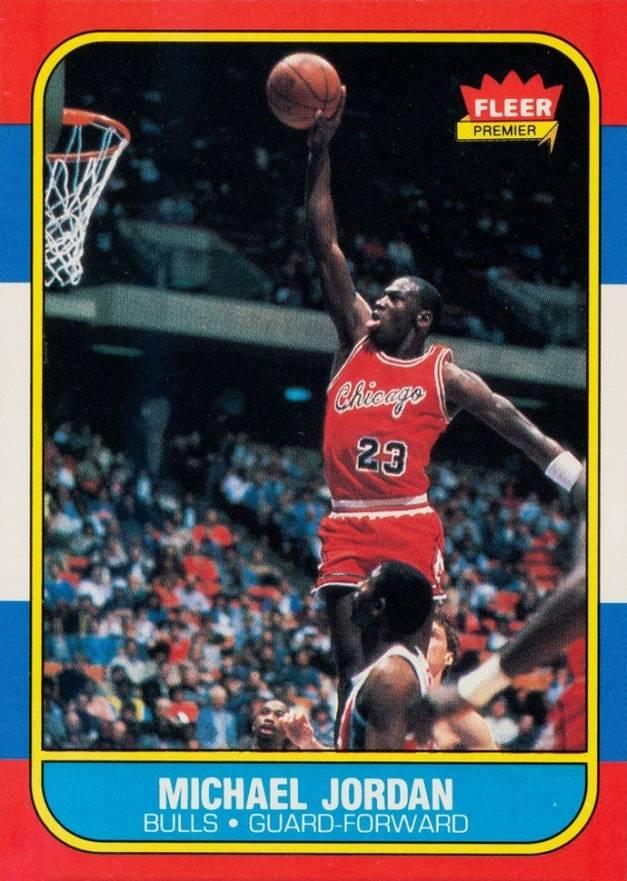

Or the 1986 Fleer Michael Jordan rookie card.

Over time, they tend to head higher. Think of it like your dividend aristocrats Walmart (WMT) or the Coca-Cola Co. (KO).

Others are more speculative. For instance, modern cards with players that are still playing in their respective leagues. Like Caitlin Clark. Or NFL superstar Patrick Mahomes.

The price swings can be volatile. Buying and selling at the right time can make you a small fortune so long as the condition of the cards live up to certain standards.

But that wasn’t necessarily always the case.

The trick was knowing the difference.

Ask an Expert

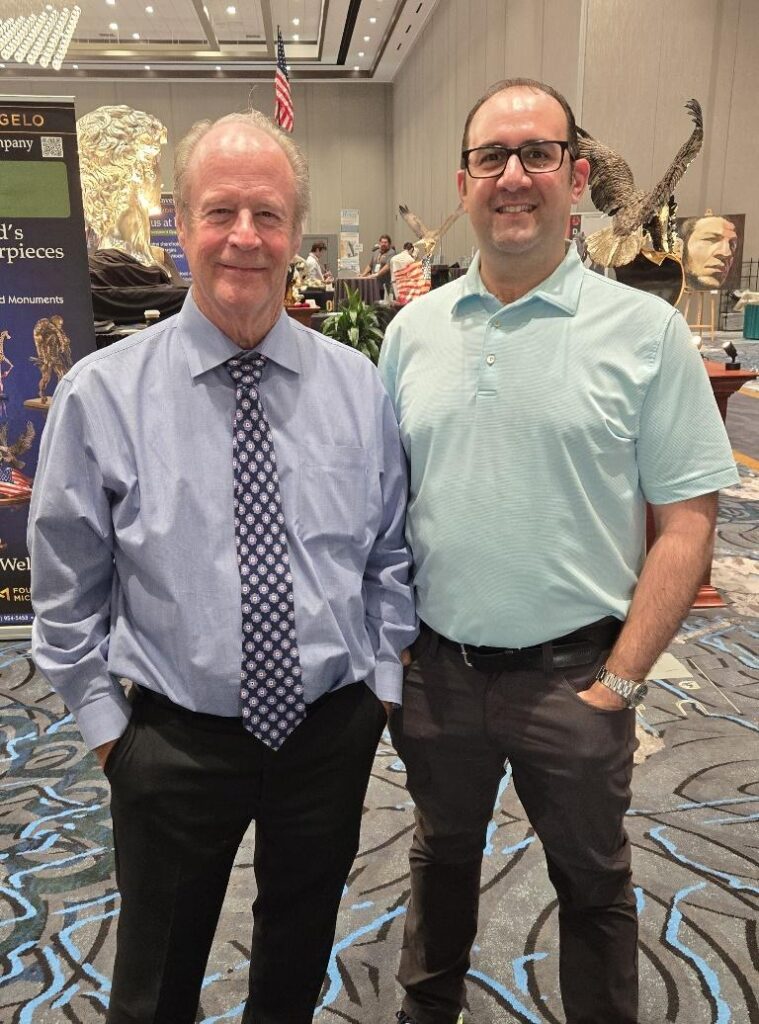

When I make an investment in a new industry, I’m eager to run my idea by someone who’s been in the business for years. That’s what I did recently when I ran into Van Simmons at FreedomFest.

You may know Van as founder and former owner of the leading coin grading service PCGS. But he also did something else. And it’s exactly why I wanted to talk to him about Caitlin Clark… and a few other sports stars.

Back in the late 1980s and early 1990s, Van and his business partner David Hall thought there was an opportunity to bring better standards to the trading cards industry.

So what they did for the coin world they set out to do again with trading cards, which was a lesser asset at the time.

Van co-founded Professional Sports Authority (PSA) to bring a standard scale to determining the condition of cards. And I had to tell him about the card I just graded and sold for more than 30-times what I paid for it.

How It Works

PSA grades cards on a scale of 1 to a perfect 10. It’s not easy to get a 10. Especially for vintage cards.

Maybe more important, each PSA-graded card has a certification number that’s put in a database. That allows you to look up each card to check whether it’s a real PSA-graded card.

It brought legitimacy to the industry. And it skyrocketed the sports-card collecting world into its own asset class.

During our time together, Van relayed a story…

David and I first started in cards back in the early 1980s. Since both he and I were longtime collectors of rare coins and other things. We found it interesting that the sports-card market wasn’t putting much importance on the quality or condition of the cards.

One of the best examples back then that grabbed my attention was the 1952 Topps Mickey Mantle. At the time, one in quality condition had a retail value somewhere between $1,000 and $1,500.

We looked at the marketplace and decided to start specializing in high-quality collector sports cards. High-quality cards were painfully underpriced! I remember saying that a gem mint card should be at least 10 times the price of a beat-up card. David looked at me and said, “The collectors will understand over time, and the pricing will reflect the difference.”

So, we decided to start a grading company for sports cards, Professional Sports Authenticators, or PSA.

Over a short time, the grading business took off. Smart collectors and investors started demanding grading and authentication.

So, the Mantle cards that I was buying in the ’80s considered gem mint would now grade Near Mint 8 or Mint 9. Very rarely a 10.

Finally in the 1990s, someone called me and said, “Did you hear a ’52 Mantle in PSA 10 just sold for 50,000?!”

I couldn’t believe it until a few hours later, when David walked in with the card! A year or so later we put the card in an auction, and it sold for about $123,000.

Grading makes a difference.

Condition makes a difference.

To us it was easy to see that big money wanted to get involved in the card market. But there were concerns over grading and authenticity. We saw hundreds of counterfeit cards over the years, and that still continues today.

Jordan rookie cards are a great example that is heavily counterfeited.

PSA changed all that.

Today, those same Mickey Mantle cards sell for tens of thousands of dollars (at least) ungraded. If you want a PSA 9, the last public sale was in 2021 for $5.2 million.

But if you want a perfect PSA 10, there are only three in existence. There haven’t been any public auctions of any of these in recent history.

Van told us that all we know for sure is that super collector Marshall Fogel bought his in 1996 for $123,000… from himself and David. What it would sell for today is anyone’s guess. Speculation says it could go for at least $30 million, maybe more.

The Big Score

As a collector, I’m always on the lookout for cards I can keep for the long term. Or cards I believe I can profit from in the short term.

It’s not unlike how I go about my portfolio. My core assets – ones I plan on holding for the long term – are typically the boring blue chips that can compound over time.

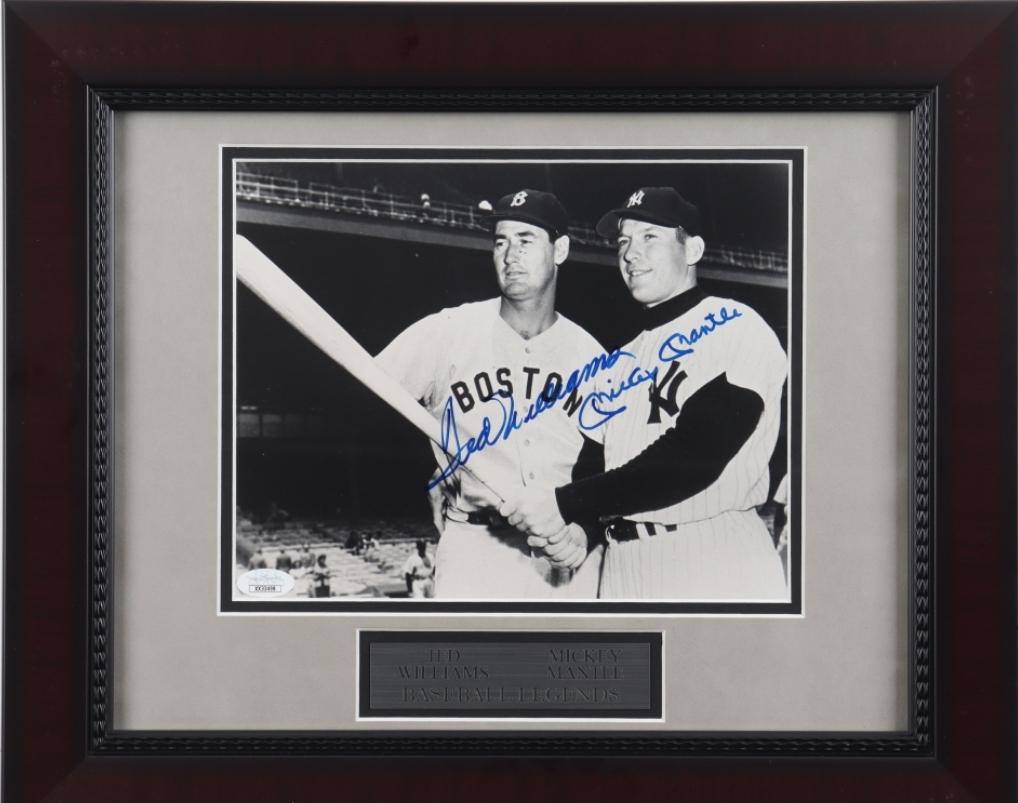

In my personal sports card collection, that’s like the dual autographed Mickey Mantle and Ted Williams framed photo hanging on my wall.

They may be boring, but I know they’re not volatile and will typically grow in value over time.

The speculative part of my portfolio is where the fun stuff happens. These are positions – like small-cap stocks or stock warrants – that have a chance to turn dimes into dollars.

These trades won’t always work out. But when they do, they can make a difference in your portfolio.

Which brings me back to Caitlin Clark.

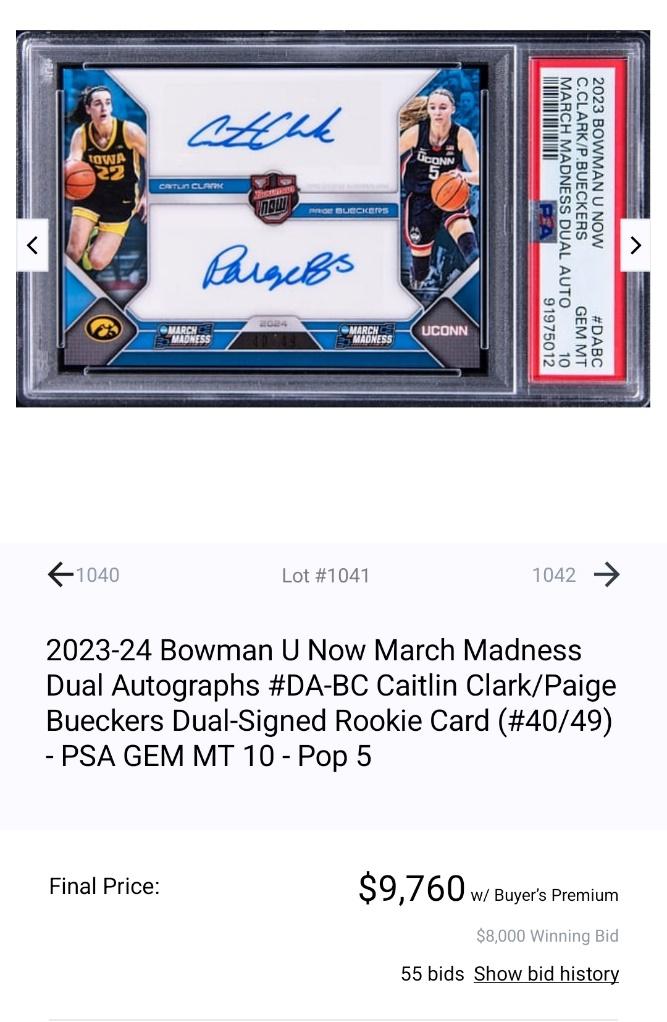

Earlier this year, I had the chance to buy a card that both Caitlin Clark and her heir apparent in women’s college basketball, Paige Bueckers of UConn, had autographed.

As a raw, ungraded card, there’s only so much other collectors would pay for it. So I had two options: Flip it for a quick profit… or grade it for a chance at even bigger profits.

After looking at it closely, I thought it had a chance of getting that vaunted PSA 10 grade. So I sent it into PSA, and about 10 days later, the grade was in…

My all-in cost – including grading – was about $250.

In most cases, a good rule of thumb is a PSA 10 is worth at least twice the value of a raw card. But that’s most cases.

In others, it’s worth far more. And when it comes to anything Caitlin Clark, that’s what’s happening today. Her cards are sending collectors into a frenzy. And that means prices are skyrocketing.

Is it a bubble?

I can’t say for sure. But just like speculating, you take profits when the market hands you a gift.

Which is why I made the decision to list it for auction. The outcome was shocking.

When the hammer fell, the total sale price was $9,760. That was far more than the average of previous sales of about $2,000 for a PSA 10 of the same card.

My cut was $8,000. A 32X return in a matter of months. It was a great score. It was unexpected. And it was a lot of fun.

But it wouldn’t have happened without Van Simmons bringing legitimacy to the sports-card market all those years ago. Or using the same risk-management tools I use in the financial markets today.

It’s a Lifestyle

As I said above, speculating with sports cards is not much different than trading stocks.

Now, I should say a 10X-plus return on anything is very rare. You shouldn’t expect that every trade will hand you a big score.

But it’s not impossible. It just takes patience… discipline… and maybe a little bit of luck.

At the end of the day, investing and trading – whether in stocks or sports cards – shouldn’t be a job. It shouldn’t be stressful.

It should be a lifestyle. When you have a system that works, you stick with it and don’t sweat the small stuff.

You stay patient. Pick your spots. Set realistic expectations. And take profits when it makes sense.

Most of all, when speculating, you never put up the mortgage money. You should only speculate with money you can afford to lose.

If you’re having fun and increasing your wealth along the way, you’re already ahead of the crowd.

And the next time you look in your own collection hiding in your closet – or your portfolio – you never know. You just may be sitting on a hidden treasure and your own 32X score.

Regards,

John Pangere

Senior Analyst, Freeport Strategic Opportunities