Burn!

I don’t expect much from the Federal Reserve.

And why not?

Because I’m not insane.

These are the people who ignited the worst inflation in 40 years by pumping $5 trillion into the financial system for absolutely no good reason… and then tried to fix the problem they created by jacking interest rates to the sky, in the process creating untold misery for borrowers.

Why we continue to give these people the power we do despite a good 25 years of evidence that they’re not particularly good at their jobs is a mystery. And yet, here we are.

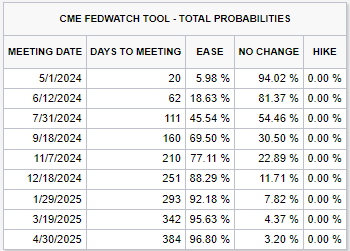

Inflation came in hotter than expected yesterday, effectively killing Wall Street’s expectations of a May 1 interest rate cut. The Fed funds futures market is now pricing in a 94% probability that rates remain unchanged at 5.25% to 5.5% (see table below).

Expectations for the June meeting aren’t all that great either. Futures traders are pricing in an 81% probability that rates stay at current levels.

It’s really not until September that the futures markets are pricing in a strong probability of a rate cut. Current odds peg it at 69.5%.

I cannot emphasize enough what a massive change in sentiment this is.

Earlier this year, the market was pricing in a better than 97% chance that the Fed would cut rates by May 1… and a 74% chance that they’d cut it by 0.5% rather than 0.25%.

Of course, traders were pricing in numbers like that because they were themselves following the Fed’s own predictions. Fed Chairman Jerome Powell and his associates were content to let the market think that three or more cuts were likely and even reinforced it via the “dot plot” and endless public comments.

That was phenomenally stupid.

Market prices are forward looking, based on future expectations. Investors, with the Fed’s blessing, priced in a very rosy interest rate scenario… one that now looks less likely by the day.

That’s why the market sold off so violently yesterday… and continued its slide today. When the inflation figures came in exceptionally hot, it forced Wall Street to confront the reality of higher interest rates for longer.

Frankly, I think it’s highly likely to be even worse than Wall Street is pricing in. In case you missed it, my friend and Freeport Society colleague Louis Navellier hosted a special Election Shock Summit last night. We recorded it and are now making it available to you. You’ll want to see this because it cuts right to the heart of how the Fed will fumble their way into changing the outcome of the November presidential election. Here’s the link for you.

About That Inflation…

The March CPI inflation report that just turned the world upside down came in at 3.5%, and core inflation, which excludes energy and food, was even higher at 3.8%. To say that’s a long way from the 2% core rate the Fed targets would be an understatement. It’s almost double.

But there’s one number that really pops off the page more than the rest: inflation in services.

Inflation in services (excluding energy services) came in at 5.4%. Even as inflation in goods – the “stuff” we buy in our daily shopping – has generally inched lower over the past 18 months, inflation in services has been stuck above 5% with no indication it’s going lower any time soon.

As for “why,” look east.

China has been struggling with deflation following its property bust. Prices there are actually falling because domestic demand is awful. So, Chinese deflation in “stuff” is spilling out over the country’s borders.

Services are a different story…

We’re suffering massive inflation in services here in the United States due in large part to a shortage of labor.

This shortage of labor is, of course, amplified by the massive amount of government deficit spending, currently around 6.8% of GDP. But it’s mostly just basic demographics. Baby Boomers are retiring, and the Gen Zers entering the workforce aren’t enough to replace them.

When the Federal Reserve let the inflation cat out of the bag, forces outside of their control – namely government deficit spending and a demographic-based worker shortage – took hold. And those aren’t so easily “fixed” with a few interest rate adjustments.

We’re stuck with high inflation, like it or not.

And in an Age of Chaos like this, I’d prefer to stay nimble and trade my way to profitability rather than just buying and holding… and hoping for the best.

Louis and I talked about exactly how to trade this environment in the Election Shock Summit we hosted last night. During that event, I explained that there are already eight stocks I’m looking to trade in the coming months. Watch the replay here for more details.

To life, liberty, and the pursuit of wealth.