Hello, Fellow Navigator.

We’re a nation of over 300 million people.

And yet, our two presumptive nominees for the presidential election are a man who first ran for president in 1988 and will be 86 years old by the end of his term… and a twice-impeached former president facing four upcoming criminal trials.

And the worst part is that we know exactly what we’ll get from a second Biden or Trump term…

- Multitrillion-dollar budget deficits…

- Unrealistic financial promises that will inevitably be broken…

- And an unsustainable debt bubble destined to end badly.

You might think we’d find better candidates by randomly choosing two names out of the phone book. And yet, here we are.

We may not love our options come November. And this year’s election promises to be particularly chaotic, as my Freeport Society friend Louis Navellier will discuss during his Election Shock Summit this Wednesday, April 10, at 8 p.m., Eastern.

During that event, Louis and a special guest will talk about just how chaotic this year could get – and the key to this year’s stock market success. Go here to reserve your spot for Louis’s event.

That said, presidential election years are usually great for the stock market.

So let’s take a look at past election years for a minute to help us determine the smartest moves to make this year…

A Usually Safe Bet

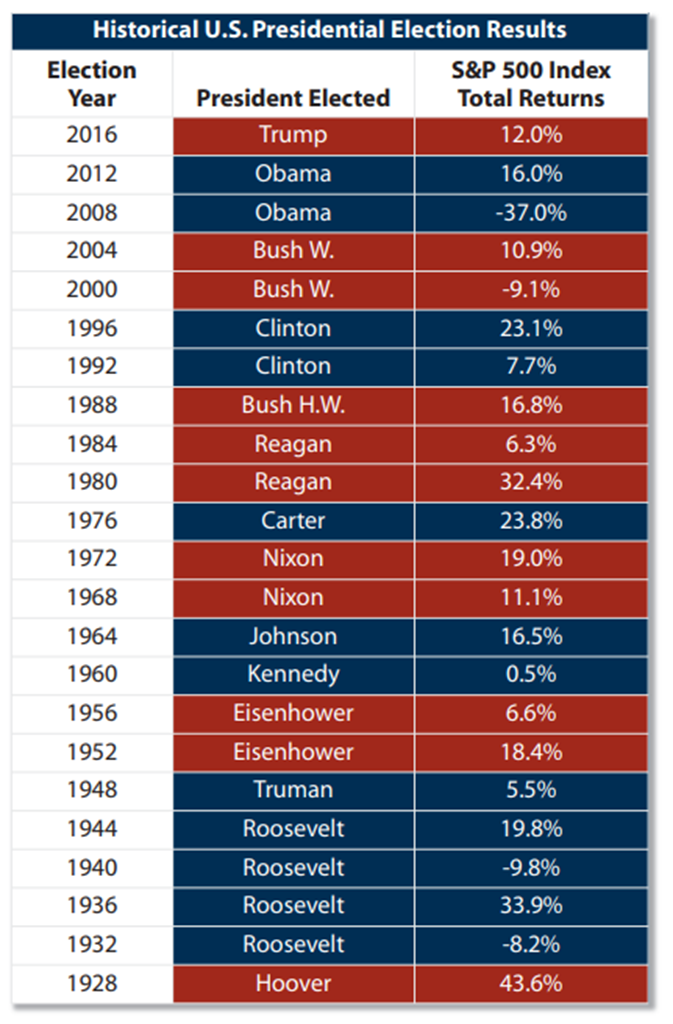

From 1928 to 2016, the S&P 500 posted positive gains in 19 out of 23 presidential election years. In years when a Republican was elected, the average gain was a solid 15.3%, while years in which a Democrat won yielded an average gain of 7.6%. (The lower figure is skewed by the massive 37% loss in 2008 leading up to Barack Obama’s election.)

Overall, presidential election years saw average S&P 500 gains of 11.28%.

Take a look at the individual market performances during the past 23 elections in the chart below.

Source: First Trust

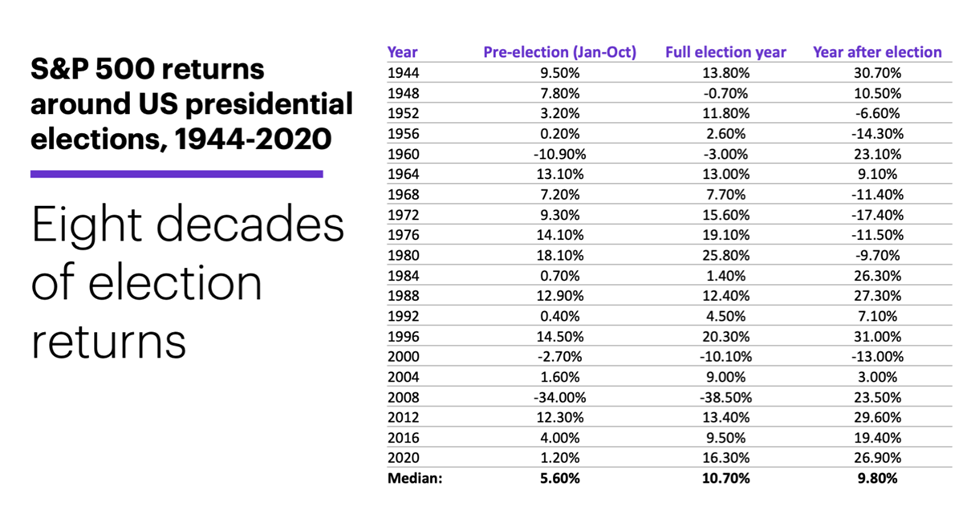

The lead-up to presidential elections tends to benefit stocks as well. For instance, between 1944 and 2020, in 17 out of 20 presidential elections, the S&P 500 recorded positive returns in the January to October windows leading up to the election, with a median gain of 5.6%.

Source: E*TRADE

This presidential election year seems to be following the same pattern. The S&P 500 is up about 8% year to date.

Even More Important Than the Election

Historically, stocks tend to rally right up to the presidential election, fueled by candidates’ pledges to boost spending, cut taxes – or somehow do both!

While the presidential election captures most of the headlines, the president isn’t the most powerful figure in Washington. That distinction belongs to the Chairman of the Federal Reserve, Jerome Powell.

Presidents Biden and Trump bear a good share of the responsibility for the post-pandemic inflation spike, having borrowed and spent previously unprecedented amounts of money. But it was Powell who dumped an absurd $5 trillion of new liquidity into the capital markets while keeping interest rates pegged at zero.

You don’t have to have a PhD in economics to understand that more dollars chasing the same amount of goods and services is a recipe for runaway inflation.

While watching his predecessors Ben Bernanke and Janet Yellen experiment with “helicopter money” during the 2008 financial crisis, Powell drew the conclusion that he could juice the money supply with impunity. It didn’t exactly work out that way. Instead, inflation that had been largely dormant for the past 40 years came roaring back… and he’s been struggling to rein it in ever since.

Not all of the action in the stock market this year is due to enthusiasm over the presidential election, of course. The market has been pricing in for months now that the Fed would start aggressively cutting rates this year.

Yet that’s suddenly looking a lot more doubtful. Data released on Friday shows that the economy added 303,000 jobs last month, surpassing economists’ expectations of 214,000 jobs. And the unemployment rate actually fell from 3.9% to 3.8%.

Make This Move Before May 1

It’s hard to see a sense of urgency for the Fed to cut rates when, by all accounts, the job market is exceptionally strong and inflation is stubbornly high.

We may be on the brink of witnessing a major policy shift coming out of the Federal Reserve, one that promises to have a major impact on both the presidential election and the stock market.

Again, my Freeport Society friend Louis Navellier is hosting an Election Shock Summit this week…

This Wednesday, April 10, at 8 p.m., Eastern, Louis will reveal the next chapter to his 2024 election forecast. Plus, he’ll be joined by a special guest who’s never done an event like this before.

Learn why the richest investors in America aren’t waiting until May 1 to move their money…

Click here to reserve your spot.

To life, liberty, and the pursuit of wealth.