Hello, Fellow Navigator.

It’s not normal for a congressman to quit in the middle of his term… particularly when his party has a razor-thin majority and every vote counts.

And yet…

Wisconsin Representative Mike Gallagher – chairman of the Select Committee investigating the Chinese Communist Party – recently announced he’ll be stepping down later this month.

This follows Colorado Representative Ken Buck, who abruptly retired last month… and, of course, former Speaker of the House Kevin McCarthy, who called it quits at the end of last year.

None of these gentlemen considered it worth their time to finish out their terms, quitting roughly halfway through. And frankly… can you blame them? The current 118th Congress is measurably the least productive in modern history, managing to pass only 34 bills last year, the lowest annual number in decades.

And yet…

Despite having virtually no legislative accomplishments, this Congress has – by some miracle – managed to add about $2.5 trillion to the national debt over the past year while throwing on another trillion every 100 days. Total spending over the past year has reached about $6.5 trillion.

It’s pretty remarkable when the most dysfunctional Congress in history can still manage to blow through $6.5 trillion, borrowing $2.5 trillion of that. But maybe it’s better that Congress is dysfunctional. If they were actually good at their jobs, we might be another $10 trillion in the hole!

I have an alternative explanation for why three congressmen have quit in the past four months… and why over 50 members of Congress and senators have decided to not seek reelection.

They’re rats fleeing a sinking ship.

The Debt Snowball

They understand the mess we’re in. Or at least they should. They and their colleagues are the ones that got us into this Age of Chaos to begin with. And when the chicken finally comes home to roost – when the debt bubble finally becomes unsustainable and the bond market goes into open revolt – they’ll be safely out of the crosshairs.

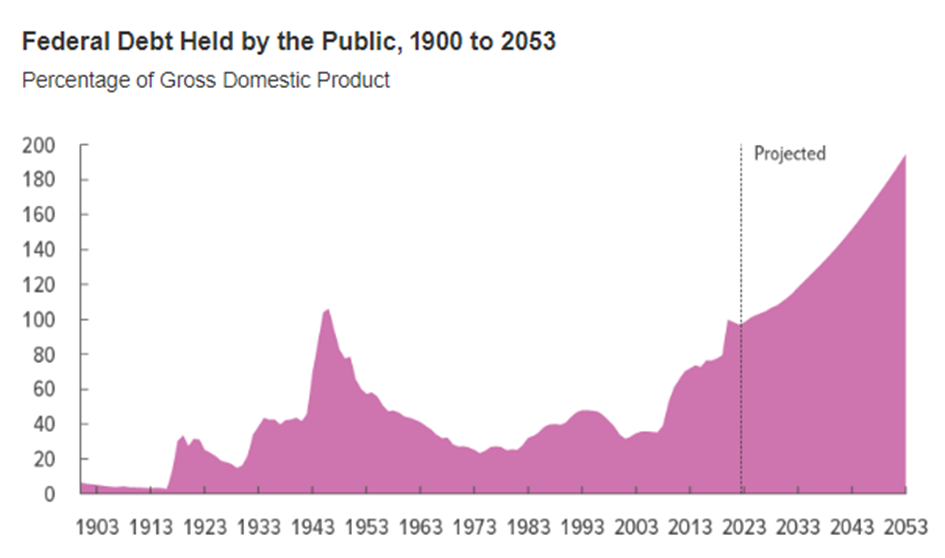

Source: Congressional Budget Office February 2023 Budget Outlook

Today, the national debt is around 100% of GDP, roughly the same level it was at the peak of World War II, when we mobilized the entire country to fight a two-front war against Nazi Germany and Imperial Japan. There’s no Hitler or Tojo threatening to take over the world today… and yet the debts continue to balloon.

Over the next 30 years, the Congressional Budget Office – which has every incentive to present a rosier picture – projects debt as a percentage of GDP to double to around 200%.

Think that sounds extreme?

We’re running a budget deficit that is 6.8% of our GDP this year, with absolutely no credible plan to reduce it anytime soon. That means we’re adding another 6.8% of GDP to the already staggering national debt… where it will continue to snowball due to compounding interest.

Even if we were to immediately pare back spending to match current tax revenues – I’m more likely to start at point guard for the Lakers on Saturday – we’d still be burdened with $1 trillion per year in interest expense from past spending excesses.

So, yes, I can see why our fearless leaders are eager to make their exits. Who wants to be left holding that bag?

Brace for Financial Turbulence

You know my views here. I think it’s irresponsible not to diversify at least a little of your wealth outside of the dollar-based financial system and into alternatives like gold and cryptocurrencies. Because the only possible solution I see going forward is some kind of accounting sleight of hand by the Federal Reserve… one that will likely massively decrease your purchasing power.

And about that…

You might want to act sooner rather than later. I believe the Fed may have a surprise in store for us in July, and no, I’m not talking about a rate cut (or a lack of one). If I’m right, we may be looking at a complete reconfiguration of the financial system as we know it.

The development of a U.S.-based Central Bank Digital Currency (CBDC) is happening on two fronts…

- The Federal Reserve is deploying the infrastructure to support a digital coin.

- America’s biggest banks are refining the digital coin itself — a coin already being traded among themselves to the tune of billions of dollars.

Here at The Freeport Society, we believe in free minds, free speech, free enterprise, and free markets. We have opportunities to thrive despite the increasingly intrusive role of technologies like CBDCs.

If you’d like to know more, click here to watch my presentation.

To life, liberty, and the pursuit of wealth.

Charles Sizemore

Chief Investment Analyst, The Freeport Society

P.S. Next Wednesday, April 10, Freeport Society friend Louis Navellier is going live with a major update to his 2024 election thesis during his “Election Shock Warning.” During that event, they’ll share one election-related play to make by May 1 before chaos could unfold. We’ll have more information on how to reserve your spot for that event as soon as tomorrow.