This news headline is why you would have to be stark raving mad to keep your savings in a bank:

Japan Raises Interest Rates for First Time in 17 Years

Now, by itself, that isn’t noteworthy. The Federal Reserve and European Central Bank have both been hawkish over the past two years. Besides, rising interest rates are good for savers.

The issue is that Japanese rates are still zero. Or to be precise, Japan’s equivalent of the Fed funds rate now has a targeted range of 0% to 0.1%.

How is it that Japan could raise interest rates and yet still have a targeted rate of zero?

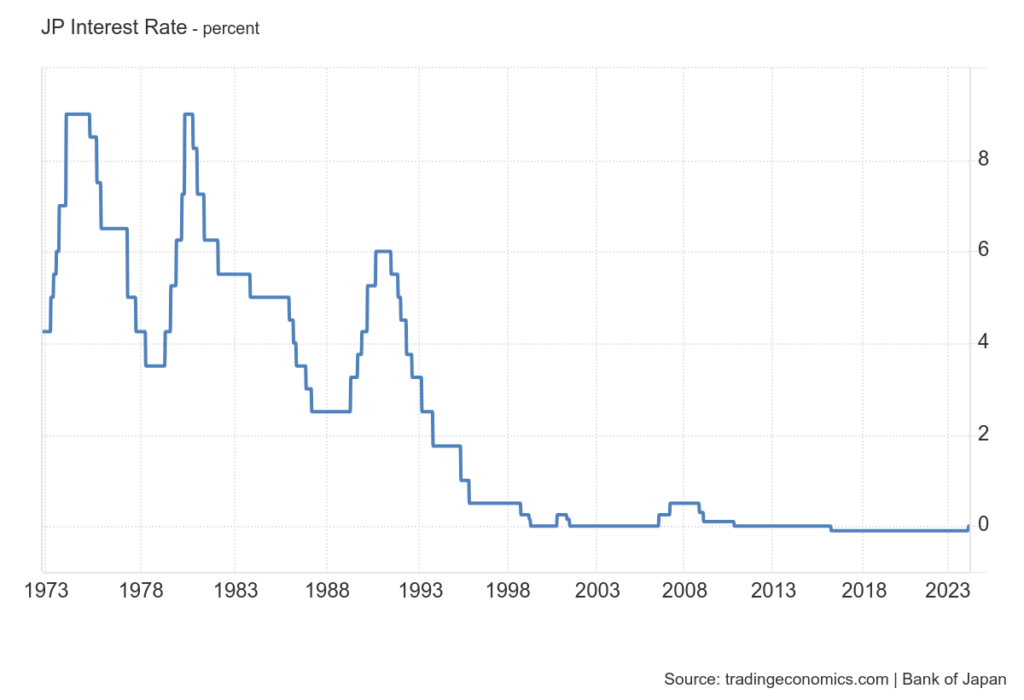

Because since 2016, Japanese interest rates have been negative. Rather than being paid interest, Japanese depositors were paying banks to take their money.

Just look at this chart…

Negative interest rates are a perversion of finance.

Interest is the “price” of money. The compensation you get from delaying gratification to save and investing rather than frittering it away on current consumption. Setting interest rates below zero punishes virtue and rewards vice.

It’s immoral.

It’s effectively a tax placed on citizens by unelected central bank technocrats.

I remember learning about a war being fought against “taxation without representation,” but then, that was about 250 years ago and on the other side of the Pacific Ocean from Japan.

Indeed, Japan is a world away, and we thankfully never had negative interest rates in America. But we have had the same kinds of people pulling most of the same stunts with the dollar.

Zero interest rates, quantitative easing, and virtually every other terrible idea put into practice over the past 20 years happened in Japan first. The Land of the Rising Sun is an experimental training ground for bad monetary policy, but that hasn’t stopped the Federal Reserve from trying it at home.

My friend Michael Gayed had an interesting take on the Bank of Japan’s actions in his Lead-Lag Report this morning:

The one thing that BoJ has done this week by essentially keeping conditions ultra-loose with significant wage pressures looming is establish a catalyst for a global systemic risk event. Japan sends a lot of investment dollars out into the world with rates hovering near 0%. If Japanese wage growth eventually spikes inflation, which in turn spikes interest rates, it’s reasonable to think that a lot of those Japanese investment dollars could begin flowing back home and out of U.S. markets. One of the things that severely destabilized the markets in 2022 was the slow response of central banks to rising inflation. It looks like we could be heading down a similar path now in Japan.

When Japanese rates were negative, Japanese savers didn’t suddenly decide to blow their nest egg at the mall. Japan’s aging population still saved its cash… but they had every incentive to put it anywhere else but Japan. Naturally, a lot sloshed across the Pacific Ocean and ended up in the U.S. market, contributing to the bubble in asset prices.

It seems that central bankers have a poor understanding of unintended consequences.

When Alan Greenspan flooded the market with liquidity following the implosion of hedge fund Long-Term Capital Management in 1998, he set the stage for the mother of all tech bubbles… which finally burst in 2000.

When Greenspan slashed rates to a then unprecedented 1%, he sowed the seeds of the housing bubble of the mid-2000s.

When that bubble burst and led to the 2007-08 financial crisis, Greenspan’s successors Ben Bernanke and Janet Yellen dropped rates to zero and introduced the words “QE infinity” into our collective vocabularies.

That set the precedent for the pandemic response in 2020… in which Jerome Powell again lowered rates to zero and dumped $5 trillion in liquidity into the capital markets. We know how that ended. Years later, we’re still dealing with inflation.

See a pattern here?

The Fed overreacts to a perceived problem… giving us a “solution” that sows the seeds for the next crisis… which will require the Fed to step in yet again.

Is it any wonder that investors are looking to dollar hedges elsewhere?

If these are people “safeguarding” the dollar, as I said, we’d have to be delusional or certifiably insane to keep all of our savings in the bank.

At The Freeport Society, we believe it’s critically important to protect ourselves from currency mismanagement. Contrary to what our neighbors, spouses, or court-mandated psychologists might say, we’re not crazy! We’re just determined to have a little insurance in our portfolios.

In this month’s issue of The Freeport Investor, due out tonight, I take a deep dive into two of the most powerful “insurance policies” we could have in our investment portfolios. To find out how to get your hands on that issue, watch this.

To life, liberty, and the pursuit of wealth.