For a group of people paid handsomely to be the “smartest guys in the room,” Wall Street isn’t looking all that bright this year.

The so-called masters of the universe have been expecting the Federal Reserve to aggressively cut rates in 2024, building just about their entire bullish case around it. Yet they’ve also been consistently wrong all year.

As recently as two months ago, futures traders were pricing in a better than 80% probability that the central bank would cut the targeted Fed funds rate by at least 0.25% by the March meeting on Wednesday. Those same traders are now pricing in only a 2% probability.

Yet hope springs eternal, and Wall Street is still expecting the Fed to aggressively cut rates later this year.

But what if they don’t?

What if inflation stubbornly sticks around and forces them to keep rates higher for longer?

I recently was discussing this with our Freeport Society friend Justice Litle, the Chief Research Officer of TradeSmith… and he had a lot to say about this “casino run by clowns with a boardwalk in front and a used-car lot in the back.”

He’s kindly agreed to allow us to reprint his thoughts on this. Thank you, Justice.

Enjoy!

The Federal Reserve Could Trigger a Violent Sell-Off on March 20

The Federal Reserve could shock markets next week. Complacent bulls should brace for impact.

To be more specific: If the Fed does what we think it could on Wednesday, March 20, the major stock market indexes could see a violent sell-off, with big tech leading the way.

So what could the Fed do on March 20 that would be so painful?

It won’t be anything drastic like a surprise rate hike. But Fed officials could adjust the “dot plot” in their summary of economic projections (SEP) – and that could trigger a violent reaction on Wall Street.

“But sir,” you ask, “what is this ‘dot plot’ of which you speak?”

Here is a refresher on the mechanics:

- The Federal Open Market Committee (FOMC) is the rate-setting body of the Federal Reserve. They meet eight times per year to set the target for the federal funds rate, which determines the short-term interest rate. (The current rate is 5.50%.)

- The main purpose of the FOMC meeting is to decide whether to hike rates, cut rates, or leave them unchanged. But the Fed Chair also holds a post-meeting press conference, and four times a year — in March, June, September, and December — the FOMC updates its “Summary of Economic Projections” (SEP), which describes the Fed’s macroeconomic outlook.

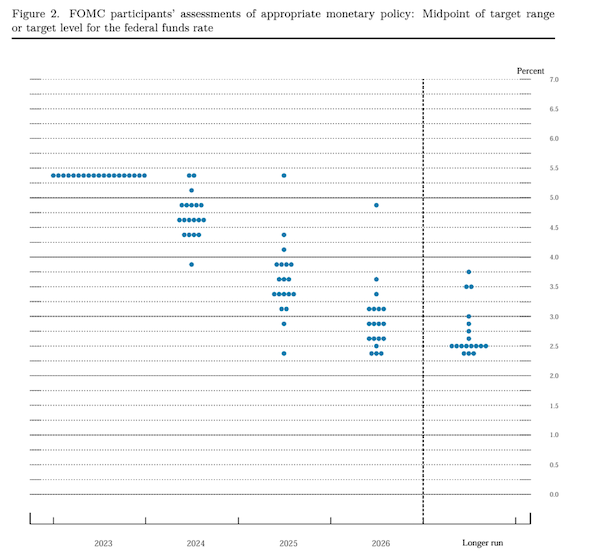

- Within each SEP report there is a “dot plot,” which contains a series of dots that look like morse code. Each dot represents the view of an FOMC committee member as to where the federal funds rate will be over the course of the coming year and multiple years out.

- Most of the time the dot plot is a snooze fest. It doesn’t often make news. But every once in a while, given a specific set of circumstances, Wall Street can be shocked into a frenzy of action, bullish or bearish, by a change in the dot plot.

The whole dot plot obsession is a bit silly because FOMC officials are no better at forecasting future interest rates than anyone else, and in fact they might be worse.

But Wall Street, in many ways, is a casino run by clowns with a boardwalk in front and a used car lot in the back — so silliness is par for the course, especially when an aggressive bull case has been manufactured from whole cloth based on what the Federal Reserve is expected to do.

Below is the dot plot from the last SEP released at the December 13, 2023, meeting to give a sense of what we’re talking about. Again, each dot represents a different FOMC member. Jerome Powell’s dot is somewhere in there too — the Fed Chair’s view is not broken out from anyone else’s. Each cluster of dots applies to a different year — from 2023 out to 2026 and then “longer run” representing 2027 and beyond.

As the dot plot shows, FOMC officials broadly expect the short-term interest rate to fall as inflation gently declines toward their 2% target.

All of this sounds academic, and in a more rational world it wouldn’t matter what a bunch of central bank officials think — after all, the predictive track record of the Fed is terrible.

It matters, though, because Wall Street has built a hyper-aggressive bull case based on the assumption that the Federal Reserve is going to be cutting interest rates a lot.

With that context in place, we can get back to our opening statement.

The Federal Reserve could shock markets next week — and put the major indexes into a violent sell-off, and trigger a rally in the dollar — by changing the dot plot in a hawkish manner, or changing their rate cut projections in a manner that shifts the dot plot.

For instance, if FOMC officials adjust their projected number of interest rate cuts in 2024 from three down to two — with the dot plot reflecting that shift — Wall Street could start freaking out.

The reason this could happen is because inflation pressures are not just magically melting away like the Cheshire Cat from Alice in Wonderland. They are showing persistent evidence of being “sticky.”

In recent days we have seen three separate pieces of evidence suggesting that inflation pressures are not melting away:

- The data release for the February Consumer Price Index (CPI) came out hotter than expected.

- The Federal Reserve Bank of New York released a consumer expectations survey showing long-term inflation expectations are trending higher in a possibly worrisome way.

- In keeping with the hot CPI, this week’s data release of the February Producer Price Index (PPI) came in hotter than expected.

One data point suggesting “sticky” inflation could be a fluke. Two such data points warrant paying attention. And three in a row say “Houston, we have a problem.” An inflation problem.

Fed Chair Jerome Powell is also aware of three important things…

- The Fed took a gamble in seeming relaxed about inflation. They gambled because a rip-roaring stock market, powered in part by an unshakeable belief the Fed will cut rates, could easily encourage the type of consumer spending from well-off households (the top 30%) that causes inflation to come back.

- Arthur Burns, the Federal Reserve Chair for most of the 1970s before Volcker came in, is broadly regarded as the worst Fed Chair in history precisely because he declared inflation too early — and allowed it to come roaring back.

- If inflation accelerates enough that the Fed has to go back into hiking mode — e.g. if they wind up having to take the federal funds rate to 6.0% or higher — the result could be total disaster on the economic front.

And by the way, what would it take for inflation to come roaring back? It’s not like the potential drivers are far-fetched.

Another spike in energy prices could do it (food prices are already a problem). A longer-term devaluation of the U.S. dollar could also do it. A debt crisis (the world losing confidence in U.S. Treasuries) could do it as well.

So getting back to the Fed and the upcoming March 20, 2024, FOMC policy meeting — Fed Chair Powell knows the Fed has a problem.

Powell also knows that, if inflation does take off again, his reputation — which looks great right now — will be utterly trashed.

So what is the logical thing for the Fed to do in response to the looming problem of a “sticky” inflation threat, as evidenced by the three data points we mentioned?

The naturally logical thing for the Fed to do at this juncture is not to panic, but to turn up the hawkishness dial by a modest amount at next week’s meeting on March 20.

We’re not talking about a huge amount of hawkish turn here, but enough to make a difference — e.g. by cutting the projected number of rate cuts for 2024 from three down to two and adjusting the dot plot accordingly.

If this indeed happens — the Fed notching up their hawkishness a bit — it could hammer the stock market because the bulls have gotten so far out over their skis with euphoric levels of bullishness rooted in hot air (magical AI plus magical rate cuts equals endless profits for everyone) that an inflation-powered wake-up call from the Fed on March 20 — even a little one — could turn a whole lot of complacent buyers into sudden sellers, triggering a short-term avalanche or even a flash crash.

Keep the popcorn handy!

Justice Litle

Chief Research Officer, TradeSmith

P.S. If you enjoyed this commentary from Justice, you can find out more about his service, Decoder, here. Thanks again, Justice.