Dennis Gartman, the writer who penned the popular Gartman Letter for 30 years, had a quote I always loved: “All economic information of any significance always starts as anecdotal.”

I may be paraphrasing.

He had a few variations of the quote over the years, but you get his meaning. By the time official statistics are released, they’re already dated due to the time lag needed to compile them. If you wait for official confirmation from the GDP, inflation, or a host of other economic reports… you’re too late.

I was pondering this on my last flight to Lima.

I spend a lot of time on planes… at airports… and even in taxis to and from the airport. It’s an unfortunate byproduct of living with one foot in Peru and one in America. But despite the ungodly amount of air miles I’ve accumulated, I haven’t gotten an upgrade to business class in years.

Demand for travel was so high – even for the expensive seats – that American Airlines wasn’t about to give an upgrade away for free.

Until my trip last week.

A Sign

On three out of my four legs, I got a complimentary upgrade to business class.

Now, it could have been a coincidence or random statistical noise. Perhaps there just weren’t a lot of people flying from Lima to Baltimore via Miami last week.

Or maybe it’s a sign that something is changing.

During the COVID-19 pandemic, when we were stuck in our homes, we bought a lot of “stuff.” I remember an endless procession of trucks delivering Amazon boxes to my door. I’m sure I’ve already thrown half of the crap away.

But as soon as the world opened up again, consumer spending switched from “stuff” to experiences like travel and restaurant dining… hence my being stuck in economy class and denied the complimentary pre-flight bourbon and steamed hand towel I so rightly deserve.

So, are we shifting again, away from experiences and back to Amazon boxes? Or, more significantly, are we in the early stages of a general slowdown?

I don’t know yet. But it has my attention.

Incidentally, what are you seeing out there? Any little anecdotes that tell you something might be changing? If there’s anything you’d like to share, reach out to me at [email protected].

While we’re on the subject of consumer spending, let’s look at what’s happening across the Pacific…

Anecdotes in China

According to CNN, China officially reported “record” holiday travel over Chinese lunar new year, but a closer look at the data tells a different story:

…according to CNN calculations based on official data, the average tourism-related spending per trip was below pre-pandemic levels, as consumer confidence remains weak amid deflationary pressure.

A total of 474 million trips were made within mainland China during the Year of the Dragon travel season, up 34% compared to the same holiday in 2023 and 19% higher than in 2019 [the last year before the pandemic], according to data published Sunday by the Ministry of Culture and Tourism…

However, the most recent holiday season took place over eight days from February 10 to February 18, which was one day more than previous periods.

An average of 59.25 million domestic trips per day were made during this year’s holiday period, essentially unchanged from the 59.29 million trips per day back in 2019. But the average spending per trip per day was actually down 6% from 2019 levels.

Here’s something that will blow your mind.

While the Federal Reserve is still struggling to get inflation under control in the U.S., China would love to have a little inflation right now. Unfortunately, they have the opposite problem: deflation!

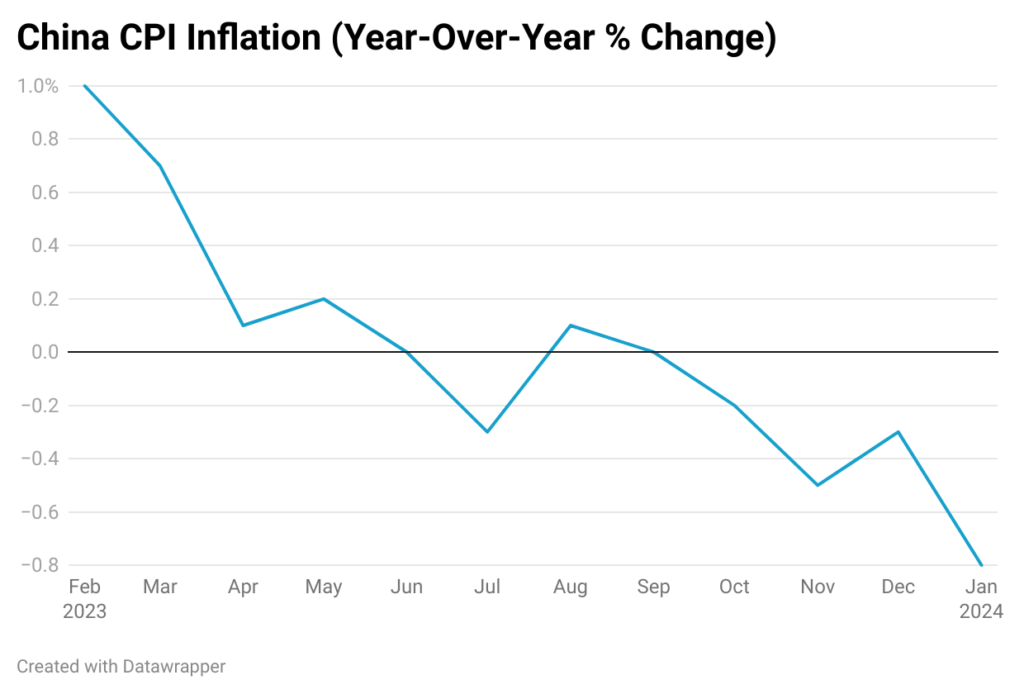

Chinese inflation has been in freefall for a year and prices today are actually falling at a 0.8% annual clip.

As for the why, take your pick.

Faced with slowing export growth, China’s government incentivized domestic construction… which led to overinvestment and a nasty bubble that is now bursting.

Evergrande, one of the largest real estate developers in China, filed for bankruptcy last year, leaving an estimated 800,000 units it had under construction unfinished.

Other developers are also on the brink, which threatens the Chinese banking system and bond market, not to mention the savings of hundreds of millions of Chinese citizens.

Construction spending made up close to 30% of Chinese GDP, according to Harvard Professor of Public Policy and Economics Kenneth Rogoff and IMF Economist Yuanchen Yang. That’s now in free fall.

Exports have accounted for about 20% of Chinese GDP over the past decade. But as I’ve been writing for months, that model is dead. After the pandemic and the ensuing years of saber rattling, Western companies are reducing their exposure to China and bringing production closer to home. Globalization has given way to deglobalization, and that’s not reversing any time soon. And this is one of many significant changes taking place, as our friend Louis Navellier explains here.

China could, in theory, boost government spending, but it’s hard to see that helping much. The country already has an abundance of infrastructure and, again, overbuilding is how they got into this mess to begin with.

Consumer spending?

Good luck with that one. As I wrote a few weeks ago, China is utterly screwed due to the after effects of its ill fated One Child Policy, and its population is shrinking. How do you sell more Nike shoes or Starbucks lattes if there are fewer people to sell them to with every passing year?

China has been touted as a success story for state-managed capitalism for the past 30 years. But before this crisis runs its course, I expect that reputation will fare no better than Evergrande’s. China is a sinking ship.

That’s why I’m more focused on opportunities closer to home. I’ve already built a solid model portfolio for The Freeport Investor subscribers. Specifically, we’re targeting five areas I believe will yield the biggest investment opportunities for us. You’ll learn what those five are in this video.

To life, liberty, and the pursuit of wealth.