You know it’s rough out there when folks start bringing out the cheap booze.

They could probably get away with serving moonshine by the night’s end, and no one would notice or care. But it wouldn’t make a good first impression.

I was pondering this as I stared into my post-Thanksgiving dinner tumbler of Johnnie Walker Blue Label, neat. (We’re spending Thanksgiving with friends in a lodge outside of Puerto Maldonado, buried deep in the Peruvian Amazon, and felt like properly celebrating with the good stuff.)

I got thinking about the possibility of moonshine digestifs after reading that Diageo plc (DEO) expects sales in Latin America and the Caribbean to drop by 20% year-over-year. Besides Johnnie Walker, the British multinational holds Tanqueray gin and Cîroc vodka within its collection of premium brands.

Now, I can say this with absolute authority: Latin Americans have not suddenly become teetotalers. I live part-time in Lima, Peru, and half the appeal is that it is socially acceptable (and even encouraged) for a middle-aged man to behave like a college kid here.

Diageo’s lousy outlook isn’t because of decreased demand. It’s because the region’s drinkers are trading down to cheaper brands.

The same inflation making life miserable in the United States is forcing cutbacks pretty much everywhere else too.

And it’s not just booze…

Is Cheap Booze a Sign of Empty Stockings?

Target Corp. (TGT) CEO Brian Cornell has been commenting for the past year that shoppers are buying fewer discretionary items and focusing on necessities. Earlier this month, he said that shoppers are cutting back even on groceries.

Budgets have gotten tight enough that shoppers are either buying less food… buying it from places cheaper than Target… or some combination of the two.

Meanwhile, Federal Reserve Chairman Jerome Powell threw an enormous wet blanket on the stock market with his warnings of inflation “head fakes” at the International Monetary Fund panel earlier this month.

“We know that ongoing progress toward our 2% goal is not assured,” Powell admitted. “Inflation has given us a few head fakes.”

He went on to say that the Fed “will not hesitate” to continue raising rates and that there was a “risk of being misled by a few good months” of inflation data.

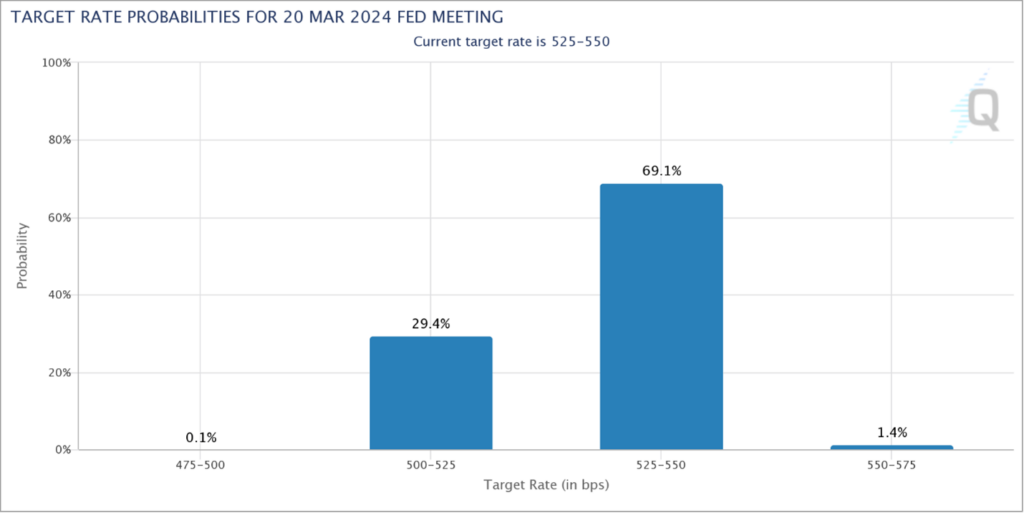

Futures traders are pricing in a 29% probability that the Fed will lower rates by March, as you can see in the chart below. Much of November’s market bounce came on the back of that hope.

The odd thing is that Powell is the most transparent and plainspoken person in his position… ever. He has said nothing to warrant investors’ blissful grasp at straws.

Powell has been saying for a year now that rates will likely be higher for longer. He has never said, implied, or suggested via innuendoes that the Fed has plans to lower rates. He’s made it abundantly clear that his worry is inflation.

He’s not alone.

Ken Griffin, the billionaire head of Citadel, one of the largest hedge funds in the world, commented at a Bloomberg event in Singapore earlier this month that inflation may be running hot for decades, and he specifically mentioned deglobalization as the reason.

For my entire lifetime, globalization was a one-way street. Every year, the world got a little flatter, and trade got a little freer, all of which was made possible by cheap and abundant (predominantly) Chinese labor.

My how things change.

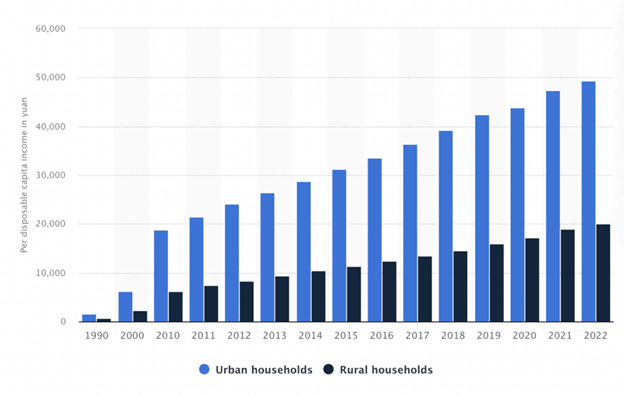

In 1990, the average urban Chinese worker took home barely $1,000 per year. By 2022, they made close to $50,000, according to Chinese digital marketing agency GMA.

I’ve seen other estimates come in lower than that. Forbes quotes the average wage in China at a little over $16,000, though this also includes lower-paid rural workers.

Here’s a chart to show this wage growth in China over the years.

Pick any number you’d like, but it tells the same story. Labor in China is no longer cheap and abundant. The single biggest factor driving globalization over the past half-century has vanished.

So, even if President Joe Biden and his Chinese counterpart Xi Jinping were to hold hands and declare themselves best friends forever on national TV, China can no longer export deflation. China now exports inflation.

But of course, Biden and Xi are not best friends forever, and U.S.-Chinese relations are now scraping the abyss. As Bloomberg columnist Hal Brands so accurately pointed out last week:

The People’s Republic of China is a Leninist state run by a party that believes the struggle for power is unceasing and unforgiving. Know that, and you’ll know what yesterday’s meeting between [Biden and Xi] does and doesn’t mean. It does mean that Xi, like Biden, has good tactical reasons for talking. It doesn’t mean that China is any less determined to overtake the U.S. as the country that sets the terms of global order — or that any amount of dialogue can change that fact.

Citadel’s Griffin had more to say along similar lines.

Circling back to his inflation comments, Griffin said that Uncle Sam was “spending on the government level like a drunken sailor” and that Americans had figured out that “something is not quite right.” (He’s a smart guy. Sounds like we should send him an invitation to join The Freeport Society.)

We’re seeing this play out in the bond market. Investor demand for government bonds hasn’t been strong enough to soak up an onslaught of new supply. Yields spiked at the auction earlier this month, meaning the government had to offer a higher rate to get investors to nibble.

That’s the problem with running $1.7 trillion budget deficits…

How to Protect Yourself from This Mess

But then, that’s what the Fed was once for. We could always depend on the central bank to hoover up excess bond supply. Except now, with the Fed focused on fighting inflation, we can’t.

I’m with Griffin. Something is not quite right here, and rising bond yields have made government spending at current levels unsustainable.

As free thinkers and investors, how can we protect ourselves from this mess? And is there a way we can even prosper as a result?

There always is.

For one, be careful with bonds and keep your exposure there mostly short-term. Buying longer-dated bonds flips the “risk-free return” into a “return-free risk.” Also, invest in (or increase your holdings in) America’s strongest companies. These quality businesses have proven their ability to withstand the test of time. You’ll find one of the best right now in my free report, 5 Unapologetically Profitable Stocks for 2024.

To life, liberty, and the pursuit of wealth.