My enduring memory of Walmart Inc. (WMT) will always be its response to Hurricane Katrina in 2005.

New Orleans looked like something out of the Day After Tomorrow movie before all the flood waters froze. Yet the government response was embarrassing.

It was a humanitarian disaster on American soil that left Uncle Sam looking both impotent and incompetent.

And then Walmart stepped in.

The company’s logistics system enabled the delivery of food and water to the hurricane refugees faster and more efficiently than the U.S. Army. When the government failed, Walmart succeeded. And it’s only gotten stronger since then.

Walmart isn’t just an iconic part of America’s retail economy.

It is America.

Ninety percent of Americans live within 10 miles of a Walmart store, and in any given month, approximately two-thirds of all shoppers buy something from the chain.

So, you can glean a lot about the state of the country by reading Walmart’s quarterly earnings reports and listening to management’s comments.

The insights it shared when reporting before the bell on Thursday, November 16, 2023 were troubling.

In today’s letter, let’s break down the “findings” from Walmart’s earnings, dissect the warnings, and make a plan to navigate what lies ahead to safety and profits.

A Consumer in Trouble

Walmart’s third-quarter fiscal earnings were a mixed bag. The company exceeded analyst expectations on revenues and earnings. And foot traffic was up 3.4% over the previous year, which was better than analysts expected. Great news!

Only…

The average ticket size was a mere 1.5% higher. A weak showing. And CEO Doug McMillon said that shopping has trailed off, noting that “in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

Investors did not like hearing that one bit, and WMT slid 7% in morning trading Thursday.

We’re in for a bleak holiday spending season, folks. All signs point to the average American scaling back, due in large part to the brutal inflation of the past few years biting into their budgets. The return of student loan repayments and the crushingly high rental and property markets aren’t helping.

I expect us to see a recession in 2024… along with stubborn inflation. The best way to hedge against that is with the shares of America’s strongest, most Armageddon-proof companies… or what I call the “Rich Man’s Currency.”

In an environment like this, you want companies in your portfolio that are largely:

- Recession proof…

- Immune to government insolvency…

- And inflation resilient.

Despite its forecasts and investors’ reactions on Thursday, Walmart checks all those boxes. In fact, that 7% sell-off in WMT stock makes for a great bargain on a must-own stock.

Investing Lessons From the Past

Talking about Walmart makes me nostalgic.

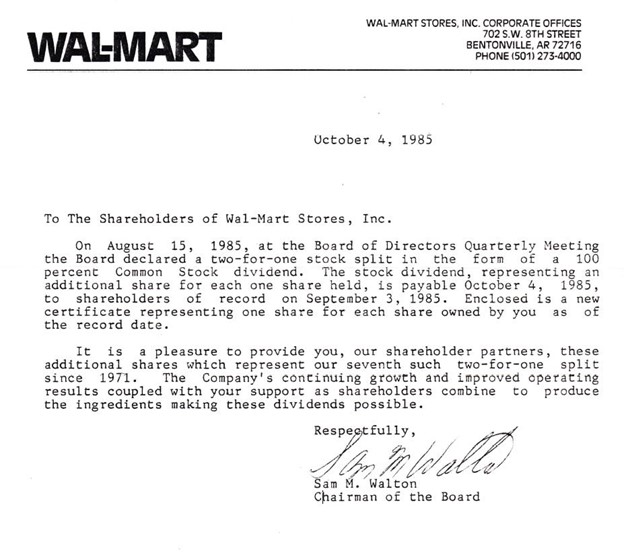

A few years ago, I was digging through an old file cabinet that had belonged to my grandfather, and I found this little blast from the past: a Walmart letter to shareholders from 1985, signed by chairman and company founder Sam Walton.

Long before Peter Lynch became a household name, my grandfather practiced his own version of the famous investor’s advice: Invest in what you know. It’s a philosophy Warren Buffett applies to his investing as well, and his success speaks for itself.

Grandpa was an Arkansas boy, born and raised near Fort Smith. He liked to invest in local companies that he could observe firsthand. Walmart was one of them, with its headquarters in Bentonville.

I remember fondly driving to the Fort Smith Walmart with Grandpa to buy a bright red Cherry Icee at the snack bar. We would walk the aisles to see for ourselves what Mr. Walton was doing with his money.

Long after my grandfather passed away, the cash dividends from the Walmart stock he accumulated in his lifetime continued to pay for my grandmother’s retirement expenses… and my college tuition.

Without a doubt, Walmart is a great American company. Make sure it’s got its rightful place in your portfolio.

Buy the best, most durable American companies… and let them do their job of compounding their earnings and compounding your wealth.

I list several of my favorites in my new free special report – The 24 Stocks for 2024: Life, Liberty, and the Pursuit of Wealth.

This report is free to you. Simply sign up to receive my new free email letter – The Freeport Navigator – and I’ll send you the details of those five stocks immediately.

To live, liberty, and the pursuit of wealth…