Editor’s Note: Our Freeport Society friend Luke Lango – Chief Investment Analyst at InvestorPlace – has crunched some numbers… and he’s identified a rare economic event that historically triggers a stock market boom. It happened three times in the past 30 years – in 1995, 1998, and 2019 – and it triggered a stock market boom on all of those occasions. In about two weeks, according to oddsmakers, there’s a 100% chance this event is happening again. That’s why Luke is hosting an urgent briefing this coming Wednesday, September 11, at 8 p.m. ET aimed at helping folks prepare for this rare economic dynamic. I invited him here today to explain why he thinks this set of circumstances is going to “work” this time again despite September’s lackluster start… and the month’s reputation for volatility and weakness. He believes this event will trigger a ton of stock breakouts, and he’s selected three trades that are set to boom. Reserve your spot for Luke’s briefing here. And make sure you read his message below.

– Charles

September is historically a terrible, horrible, no good, very bad month for stocks – and Tuesday certainly lived up to the reputation.

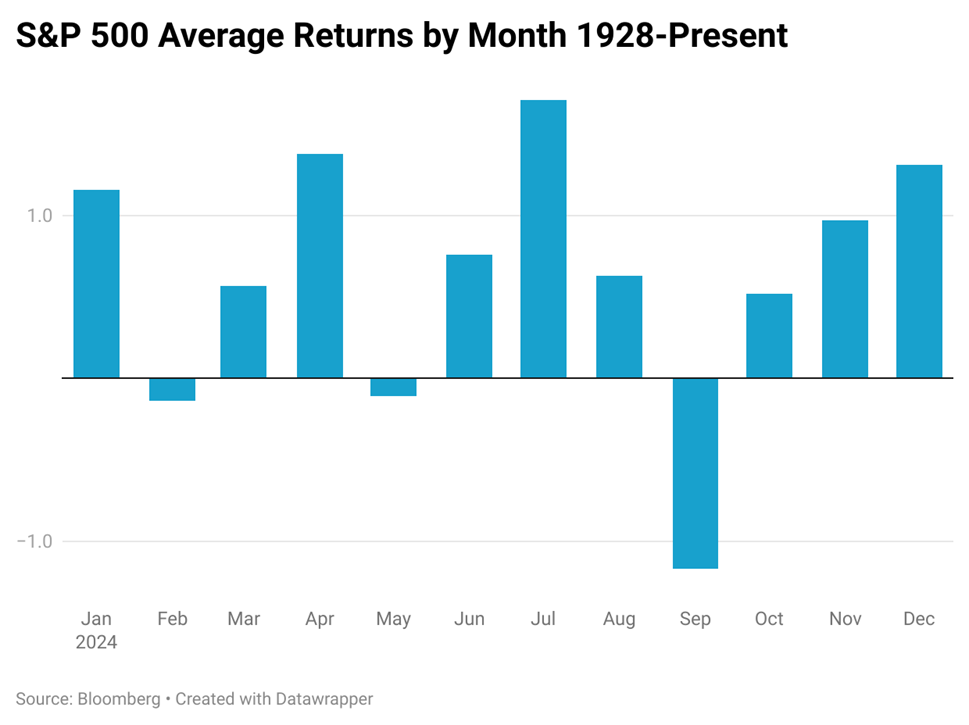

Over the past roughly 100 years, stocks have averaged a 1.2% drop in September, making it the worst month for stocks by a wide margin.

The past five years have been especially bad for September trading. Since 2019, stocks have averaged a 4.2% drop in the month.

And Tuesday was, quite simply, awful. The S&P 500 dropped more than 2% in one of its worst days of the year.

So… September’s a wash, right?

Time to sell and come back in October?

Nope.

It’s time to buck the consensus and buy stocks in September.

Why?

Because a unique event set to take place in about two weeks could make this September the best – not worst – month of the year for investors.

Here’s what I’m talking about…

Take Advantage of Others’ Recession Worries

Right now, lots of folks are worried about a recession. Those fears make sense. Unemployment rates are ticking higher. Job openings are moving lower. Consumer spending is slowing while consumer confidence is weak.

If all these trends continue, the economy could very well plunge into a recession.

But those trends will likely start to reverse course in about two weeks – because a very specific, very powerful, and very rare economic dynamic is set to emerge.

This set of circumstances has occurred just three times in the past 30 years. Every time it has, it strengthened the economy and sent stocks soaring higher – even if they were dropping beforehand.

For example, in 1998, the economy was weakening, and stocks were falling throughout the late summer and into the fall. In fact, the S&P 500 dove nearly 20% that summer.

Then, in September 1998, this rare economic dynamic emerged. As you can see playing out in the chart below – which shows the strong parallels between this year’s market performance and 1998’s – from October 1998 to July 1999, the stock market soared almost 50%!

We think a similar dynamic is set to emerge in about two weeks. When it does, I expect it to result in the same outcome it produced in 1998 – a major stock market rally.

The Stocks That Will Win

The U.S. economy appears well positioned to achieve a soft landing in late 2024. From there, the economy should regain its strength in 2025 as we move past the U.S. presidential election (elections always cause short-term political angst and market volatility) and the artificial intelligence investment boom continues with vigor.

Stocks will charge higher. AI stocks will remain the biggest winners.

In our view, the go-forward path for markets is clear and positive. After this event, the economy will grow stronger. Earnings will push higher, and so will stocks…

Especially AI stocks.

Indeed, for all the talk out there of an “AI Bubble,” the data actually suggests that we remain in the early innings of a continued AI Boom.

For example…

- Electronic design firm Keysight Technologies (KEYS) recently reported that businesses are re-architecting data centers for AI, leading data center operators to upgrade to high data-rate networking products in bulk – massively boosting Keysight’s business. On a conference call with analysts, the company’s CEO said that it’s becoming quite clear that AI will be a transformational technology.

- Integrated circuit maker Analog Devices (ADI) says that it is observing customers’ huge efforts to modernize and digitize the electrical grid in response to the massive AI infrastructure buildout going on right now.

- Telecom infrastructure firm Dycom Industries (DY) notes that demand for low-latency AI data center connectivity solutions is growing rapidly.

- Tech solutions provider Unisys (UIS) reports a 25% increase in new business signings in the first half of 2024, primarily driven by new AI services. Its large language models (LLMs) are helping media firms create dynamic ads for targeted audiences and allowing restaurants to collect data on payment channels to improve restaurant operations.

- And data center operator GDS (GDS) recently provided a very bullish read on the Asian data center market this morning.

The evidence here is clear. The AI Boom is yielding real and significant financial benefits across the global economy.

So, don’t just buy stocks. Buy top AI stocks – that’s where the growth is happening right now.

The Answers to Your Questions

So, what exactly is this dynamic that could push stocks (especially AI stocks) higher?

How does it emerge?

Why is it so rare

And how does it drive stocks higher?

We plan to answer all those questions and more in an urgent briefing this coming Wednesday, September 11, at 8 p.m. ET, aimed to help you prepare for this rare economic dynamic.

A little before 8 p.m. ET, I’ll send you an email with the subject line [The Great Tech Reversal of 2024]: Your Access Link. To join me, you’ll just click the link in that email.

To make sure you get that email, just reserve your spot for my briefing by clicking here.

I know you’ll want to be there, as this major market event is scheduled for the following week.

I believe it will send a group of stocks soaring higher than anyone can imagine.

How do I know? Because this same dynamic emerged in 1995, 1998, and 2019.

In 100% of those cases, it triggered a massive boom.

This event will only happen once. If you miss this chance, you won’t get another.

Most importantly, at this briefing, we plan to unveil a game plan to help you potentially profit from this rare economic dynamic.

So… don’t run away from the current market volatility because September is usually a bad month for stocks.

Rather, embrace it. Attend our special briefing this coming Wednesday, September 11, at 8 p.m. ET. And learn how to potentially turn this volatility into profits.

Reserve your seat to that briefing now.

I’ll see you there.

Luke Lango

Chief Investment Analyst, InvestorPlace