Trading is risky, but long-term investing is safe.

You’ve probably heard some version of this old chestnut over the course of your wealth building journey.

Maybe your financial advisor chants it like a mantra…

Maybe you’ve read it on the Motley Fool or any number of other “sensible” financial websites…

You may have even heard the great Oracle of Omaha himself, Warren Buffett, say something to that effect….

Intuitively, it sounds right.

There’s just one problem…

It’s not true!

Nor is it entirely false.

Instead, it’s that most dangerous of all beliefs – a half-truth.

You can see an outright lie coming a mile away and you know to keep your defenses up. But with a half-truth, you’re likely to let your guard down… and get burned.

That makes it flat-out dangerous to your wealth.

So, here’s the whole truth, in what nuance and detail we can cram into a daily e-letter:

Short-term trading can be risky, and long-term investing can be safe.

But as we’ll explore today, short-term trading is only risky if you have sloppy risk management.

And long-term investing is only safe if your time horizon is 20-30 years or more.

Make sure to stick around to the end. I have important news about a new trading system you can use to stay ahead of the buy-and-hold crowd.

Let’s tackle long-term investing first…

When Blue-Chips Go to Zero

There is no better way to compound your wealth than buying and holding the world’s best blue-chip stocks.

You can buy a basket of blue-chips such as Apple, Microsoft, or Johnson & Johnson. Or you can buy an exchange-traded fund (ETF) that tracks a broad index such as the S&P 500.

There are different ways to skin that cat, but the results are more or less the same. As these businesses grow, and their earnings compound, so does your wealth.

Great!

The problem is that timing a long-term investment is every bit as important – if not more important – than timing a short-term trade.

Had you bought the S&P 500 at the peak of the dot-com boom in March 2000, you would have made no money on your investment until May 2007.

Then the 2008 financial crisis caused another crash. And the index didn’t surpass its 2000 peak again until March 2013.

So, if you invested in March 2000, it would have taken about 13 years to see a sustained positive return on your investment.

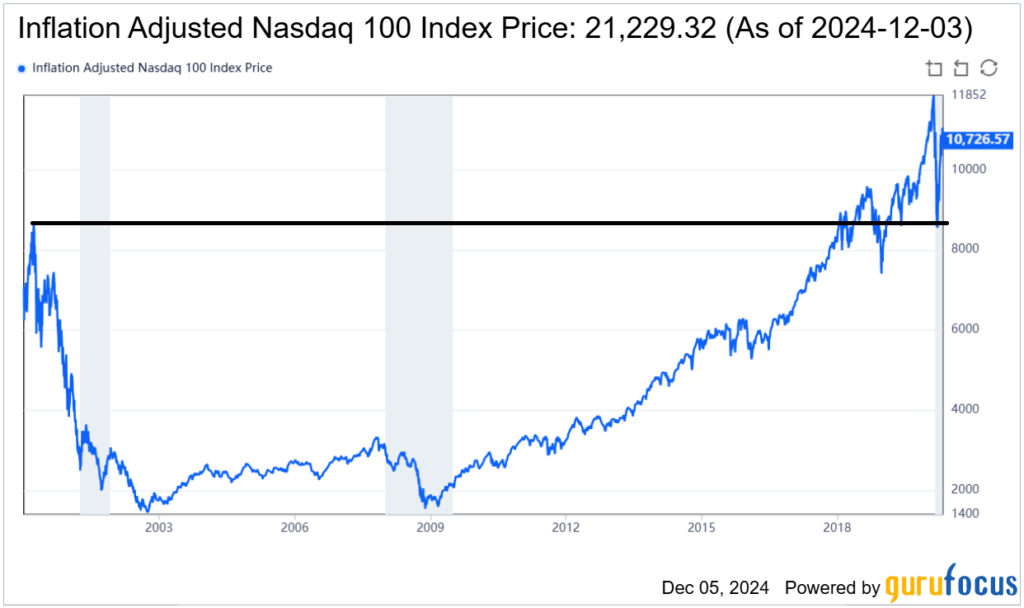

Looking at the Nasdaq 100 – which is packed with giant tech stocks – you would have had to wait until April of 2020 to see it surpass its March 2000 high in a sustained way.

Twenty years is a long time to go without a return.

And this wasn’t the only stretch in which stocks went nowhere.

It took about 30 years for the Dow to recoup its 1929 highs… about another 30 years to see its 1965 inflation-adjusted high.

And these are the broad market indexes.

History is littered with the corpses of blue-chip companies that lost their way and eventually saw their share prices fall to zero.

Enron, Pan Am, Lehman Brothers, Eastman Kodak, General Motors, Sears, Blockbuster Video… the list goes on.

Some – like Enron – hit the wall because of fraud. Others – like Lehman – were downed by overzealous managers who didn’t heed financial risk. Others still – like Eastman Kodak, Blockbuster Video, and Sears – simply failed to keep up with the times.

In every case, investors who held on for the long-term saw the value of their investments fall to zero.

Does that sound low risk to you?

No. Me either.

Now, onto the next question on the table today: Is short-term trading risky?

Taking the Risk Out of Trading

You can, of course, lose money trading. If there was no risk, there would be no return.

But that’s where sound risk management comes in.

While no two traders are going to have the exact same rules in place, sound risk management comes down to two main considerations.

The first is position sizing.

That’s just a fancy way of describing how much money you allocate to a particular trade.

Trading is all about having the odds on your side over time. You’ll take some losses along the way. But so long as your gains outweigh your losses over time, you’ll make money.

You might, for instance, put 1% of your trading account at risk for every trade you make. That way, no single trade can wipe you out. And you can play the long game of letting your winners outweigh your losers.

Second, you need to have a predetermined exit strategy.

This means answering two important questions: If your trade goes the way you hope, when do you take profits? And your trade goes against you, when do you cut your loss?

Deciding that before you enter every trade takes the emotion out of trading.

But once you’ve made your decision, you have to stick to your plan. In my experience, most traders who fail do so because they neglected to follow their own rules.

Why am I telling you this today?

Beware of Bullishness

The euphoria I see in the U.S. stock market right now makes me a little uncomfortable.

Three stocks – Apple, Nvidia, and Microsoft – are each individually worth more than 10% of the country’s annual economic output (as measured by GDP).

And a fourth stock, Amazon, isn’t far behind.

These are the biggest, baddest and most profitable tech companies ever created. Maybe a valuation like that is justified. Afterall, they’re more powerful than most national governments and wield more influence.

But, when I see such high levels of bullishness, I get a pang in my gut that tells me something isn’t right.

How bullish are investors right now?

The AAII Sentiment Survey offers insight into the opinions of mom-and-pop investors by asking them their thoughts on where the market is heading in the next six months. (It’s been doing so since 1987.)

Right now, 48.3% of investors say the market is heading higher over the next six months.

That’s far above the average level of bullishness of 37.5%.

It’s also not far off the July 2007 peak in bullish sentiment of 49.2%. The S&P 500 went on to peak on October 9, 2007. From there, it fell 57% to its post-financial crisis low on March 9, 2009.

Let me be clear: I’m NOT calling for an imminent crash. At The Freeport Investor, we’re holding long-term stock positions.

But I also don’t want to be the sucker left holding the bag.

That’s why, right now, I prefer short-term trading strategies like the ones I’ve used to generate at least 100%+ winners and a dozen double digit winners in my Freeport Alpha service this year.

It’s also why I’m excited to see that colleague and tech investing expert Luke Lango is releasing his first-ever trading service.

It’s one of the best I’ve seen…

So, let’s dig into the system, see how it works, and see if it’s right for you…

How to Turn $20,000 Into $339,000

From April 2019 to April 2024, the stock market rose by 85%.

During that same time, Luke’s new trading strategy generated a cumulative return of 1,595%, as shown by his market studies.

That’s 18.6 times better than the broad market.

For reference, an 85% gain would increase the original $20,000 to $37,000.

With a 1,595% gain, that same $20,000 stake turns into $339,000.

We’re talking about a stock trading system that outperforms a conventional index fund by a huge margin.

And looking longer term – over a 20-year period – Luke’s system returned 19,219% from April 2004 to April 2024.

That’s a 33.5x outperformance of the S&P 500 over that same time frame.

That’s enough to turn a $20,000 stake into more than $3.8 million.

How does Luke do it?

By investing in America’s best stocks for 30-day windows.

Next week, Luke will explain exactly how this all works. Sign up – for free – to watch next Wednesday at 1 p.m. ET.

He’ll show you how he and his team developed this new trading system… why it’s been outperforming a buy-and-hold strategy… and how it delivers gains even when the broader market is falling.

See you there.

To life, liberty, and the pursuit of wealth.

P.S. As the Age of Chaos rolls on, I’ve been increasingly encouraging you to take advantage of the power of options in your investment strategy. They give you the power to leverage moves in underlying stocks.

But not everyone wants to trade options. Nor do they have to.

Luke’s new system has produced similar outsized returns in back tests without using options or leverage of any kind.

If you have a regular online brokerage account, you can follow Luke’s 30-day trades.

Luke’s system produces about 5 to 20 buy signals each month. All you have to do is buy them all and then forget about them for the next 30 days. Then you sell and start over again.

Here’s that link again to find out more about how Luke’s strategy works.