Costco is running out of gold…

And if you own the yellow metal – or are considering buying some – you’ll want to pay attention.

The wholesale giant has been selling gold bars since 2023. But its gold offerings are usually limited in quantity.

So, when news breaks that Costco can’t keep gold bars on its shelves, it means demand from Mainstreet investors is spiking.

And right now, Costco warehouses across America are running out.

Bloomberg reports that 77% of the 101 stores it surveyed in the first week of October had sold out of the bars.

It’s no wonder…

Analysis from Wells Fargo shows that Costco has been averaging $100 to $200 million in gold sales – a month.

And on a recent earnings call, the company’s CFO Gary Millerchip said gold was a “meaningful tailwind” to the company’s quarterly e-commerce sales.

Costco does a quarter of a $1 trillion a year in sales. And it’s selling gold in large enough quantities to have a meaningful impact on earnings.

Oh, and it just started selling platinum bars, to the same fanfare!

So, what’s going on?

As I’ve been showing paid-up subscribers of our Freeport Investor advisory since I first recommended gold in December 2023. (To join, click here.)

And judging by what’s happening at Costco, that kind of thinking is starting to go mainstream.

But don’t worry if you haven’t bought some gold already.

As we’ll look at today, two powerful tailwinds will keep gold rising well into the next decade.

Climbing the Wall of Worry

Gold is up about 30% since the start of 2024.

That makes it one of the best performing assets this year.

For instance, the S&P 500 is up just 22% over that time. And it’s not far behind bitcoin’s 43% ascent.

And the factors pushing gold higher are all still in place.

For one, the inflation news that broke Thursday morning wasn’t good.

The government official inflation measure – the Consumer Price Index (CPI) – came in stronger than expected for September. It was 2.4% compared to the 2.3% economists forecast.

And core CPI also came in higher than economists expected, at 3.3% vs the expected 3.2%.

This is a better gauge of the overall trend because it strips out food and energy prices that swing wildly from month to month.

But those are the surface numbers.

The picture worsens when you dig into the data.

Services inflation is still running at a 4.7% yearly clip. Housing costs are rising at 4.9%. There are no signs either will slow any time soon.

This all upsets the narrative that the Fed has tamed inflation with its rate hike cycle.

And given that the Fed has started cutting rates, it raises the unpleasant thought that inflation could come roaring back.

That alone is reason enough to pick up gold bars on your next Costco run.

It’s a big reason so many others are doing it.

Per one Reddit user,

You have people that are terrified of inflation destroying the value of their fiat cash, so they convert their money to something that will hold its value i.e. gold.

Snowball Effect

The dollar is backed by the “full faith and credit” of the U.S. government.

These are the same folks who racked up $36 trillion in debt (in peacetime!) and who continue to add about $1 trillion to that tally every 100 days.

That full faith and credit doesn’t seem worth much anymore.

The Congressional Budget Office forecasts the debt will grow by another $20 trillion in 10 years.

That’s ludicrously naïve… shamefully dishonest even. The numbers indicate it will blow past those forecasts far faster.

At the rate our fearless leaders are piling on new debt, we’ll hit another $20 trillion before the end of the next presidential administration.

And I expect it will be a lot sooner given what Kamala Harris and Donald Trump’s spending and tax proposals will do to the budget.

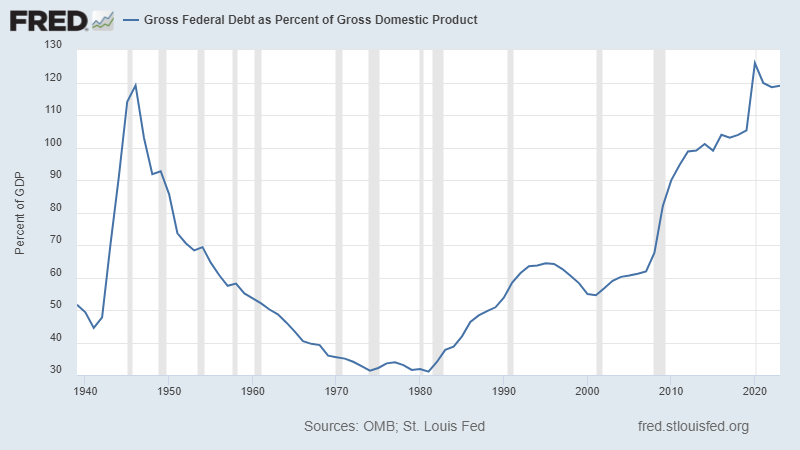

Federal debt is already more than 120% of GDP. That’s higher than it was at the end of World War II.

Except this time, there’s no light at the end of the tunnel.

There’s no logical end.

There’s no Hitler to defeat.

It’s just a snowball effect of poor financial decisions that have compounded over the past 40 years.

There’s not a lot we can do about any of this.

“Voting the bums out” sounds like a great idea, but who do you replace them with?

Donald Trump?

We’ve seen this movie before. Trump added about $8 trillion to the national debt. Asking a man who managed to bankrupt multiple casinos to balance the country’s books is absurd.

Kamala Harris?

The Biden and Harris administration added $6 trillion to the debt pile. There’s no reason to believe a Harris-Walz administration would apply the fiscal breaks.

In short, the dollar will continue its march to zero, regardless of who steps into the Oval Office come January.

And regardless of what the Fed says or does, inflation is not tamed.

Time to Buy Some Insurance

All this means gold is a must have in your investment portfolio.

It’s insurance against inflation, dollar collapse, and the financial Armageddon that lies in our future under either President Harris or President Trump.

There are many ways to own gold.

At The Freeport Investor, we’re invested in the SPDR Gold MiniShares Trust (GLDM).

It carries lower fees than the more popular SPDR Gold Trust (GLD). But it still gives you exposure to physical gold.

And we’re up 29% since entering the position last December.

The other way is owning gold directly

And buying gold bars from Costco is one of the most cost effective and easiest way to do it.

You not only get the safety that owning gold directly brings, you also get 2% back when using the Costco Citi card… another 2% in rewards for executive members… and a generally better price than what a precious metal retailer would charge.

So, if you’re not a Costco member, best get signed up.

To life, liberty, and the pursuit of wealth.