Inflation is dead. Or so the powers that be would have you believe.

We all remember the days following the 2020 lockdowns. Shortages popped up everywhere. The Federal Reserve fired up the printing press, churning out $3 trillion.

Everything seemed fine… until it didn’t.

The combination of a massive influx of cash into the system and those shortages eventually led to inflation screeching higher. At its peak, the Consumer Price Index (CPI) – the benchmark inflation number – hit 9.6%.

That forced the Fed to to hike overnight lending rates as fast as possible. The Fed claims it worked.

But the stabilization of the supply and demand chain for everyday goods contributed as well.

Yet, for us folks who live in the real world and not in the protected, hallowed halls of government, the burn of inflation has barely ebbed. That’s because what we’re really seeing is disinflation. That’s when the rate of inflation slows down. There’s still inflation… it’s just not raging like it was before.

Unfortunately, what’s coming next may make the inflation of the past few years look like a pleasant afternoon at the lake. That’s why protecting against it is more critical than ever before. Even more so with the election shock my friend and colleague Charles Sizemore sees just ahead…

History Rhymes

Inflation has been a part of monetary history for as long as we’ve had… well… money.

Protecting against inflation also isn’t new.

The first inflation-indexed bonds were from 1780 during the American Revolutionary War. The Commonwealth of Massachusetts issued them to soldiers… as sort of deferred compensation for their service.

Source: Heritage Auctions

Wartime economies are inflationary because war is expensive. So in 1780, the issuing government tied these bonds to an index of consumer prices:

Both principal and interest to be paid in the then current money of said State, in a greater or less sum, according as five bushels of corn, sixty-eight pounds and four-seventh parts of a pound of beef, then pounds of sheeps wool, and sixteen pounds of sole leather…

These bonds also came at a critical point in the war. Morale was low among the U.S. Army after the British took Georgia and Charleston, South Carolina. These bonds gave soldiers some assurance that any money paid to them wouldn’t be worthless… so long as they won the war.

My point is, inflation is nothing new. And centuries ago, people recognized it was due to things like runaway spending.

That’s something our politicians are exceptionally skilled at…

They’re All the Same

When it comes to government spending, many people believe that who’s in power matters.

I hate to break it to you, but that’s not true.

Republican or Democrat, they all spend money like drunken sailors on shore leave… or public “servants” seeking reelection.

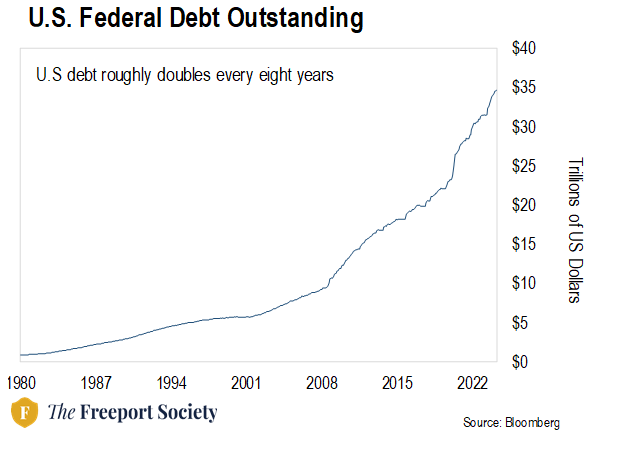

Don’t believe me? Take a look at this chart below. It shows government debt going back to Ronald Reagan.

What the chart shows is that pretty much every eight years – or every two-term president – U.S. government debt doubles.

Under Ronald Reagan, the debt grew 185%.

Under George W. Bush, it grew 93%.

Under Barack Obama, it grew 78%.

George H.W. Bush and Bill Clinton together sent it up 111% over a combined 12 years.

With Donald Trump, the debt spiked $7.2 trillion in four years. That’s a 36% increase.

To date with Joe Biden, nothing is much different. The debt is up 25%.

So regardless of whether Trump or Kamala Harris wins come November 5, that number will simply continue its meteoric rise.

How bad are we talking here?

Revitalizing American Manufacturing

Part of Trump’s platform is to revitalize American manufacturing.

Growing up and living in the Midwest, I’ve seen the downfall of the industrial manufacturing base firsthand. Just take a drive through areas like Youngstown, Ohio – where I visit frequently – and you’ll see all the old, boarded-up factories.

Offshoring of our manufacturing base decimated an entire segment of the population. So I can appreciate the idea of wanting to bring manufacturing back home.

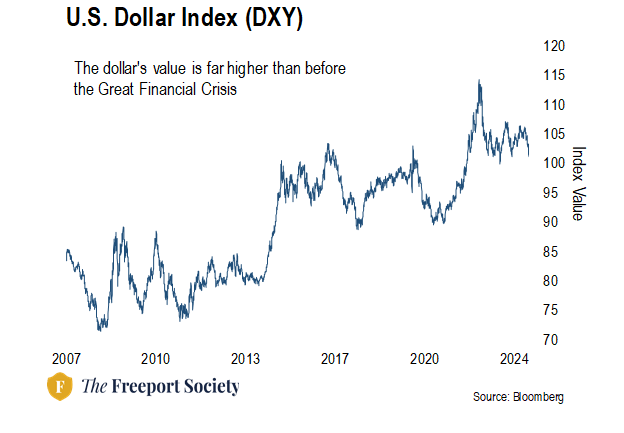

But the only way to do that is by devaluing the dollar.

A strong dollar means we can buy goods cheaply from other countries. That’s the current situation…

To really start making our own stuff on American soil again, we’d need a weaker dollar. We need to slap tariffs on imported goods to protect our homemade ones.

That means things will probably get more expensive.

It doesn’t look any better for consumers with Harris at the helm…

In a recent speech, she talked about capping prices at the grocery store to rein in greedy price gougers.

Just look to Venezuela and the Soviet Union to see how badly that will go.

Besides, the grocery business is notorious for having thin profit margins. Today they average about 1.4%. It’s a cutthroat business. Supermarkets only survive by offering consumers the best prices they can.

What many politicians fail to understand is that food prices aren’t rising because of greed. They’re rising because the political class went wild… spending too much money. They lowered interest rates to almost nothing, creating a credit boom and gave trillions to anyone with their hand out.

So, instead of trying to let the market fix the problem of high prices, Harris wants to legislate a solution.

The consequences will most likely end up creating shortages. Which means more dollars chasing fewer goods in the end. And that leads to, you guessed it, higher prices.

In the wise words of Lieutenant Lockhart in Full Metal Jacket, “It’s a big s— sandwich, and we’re all going to have to take a bite.”

Don’t Be a Victim

When it comes to spending, Trump and Harris are two sides of the same coin. Both are intent on spending more money. That will lead to inflation again. Heads we lose. Tails we lose.

Forget disinflation. It’s going to get hot out there again before we know it.

And to be clear, I’m not arguing for one or the other. While we have distinct opinions, our job at The Freeport Society isn’t to pick sides. It’s to read between the lines and find out the best ways to help protect and grow your wealth.

Under the tangible threat of reignited inflation – and the election shock our Chief Investment Strategist, Charles Sizemore, expects to hit us soon – it is critical you take action sooner rather than later.

One of the best ways to do this is to own hard assets like gold and silver… real estate… commodities… and even bitcoin. That’s five assets to grab now.

These assets act like an insurance policy against rising prices. They may not pay you to hold them, like a dividend-paying stock. They may not be exciting, like the hottest tech stocks of the day. But you’ll be glad you have them when disaster strikes.

Buy them when you can. Not when you have to.

And watch your inbox tomorrow. Charles is going to share details about the election shock he’s preparing for. As is now being reported, this election shock could see government spending increase by nearly 5X.

Accordingly, Charles will show you what you can do to further protect and grow your wealth.

Until then, stay vigilant, stay nimble.