I’m used to seeing things that don’t make sense. Not much has made sense in the capital markets since the Federal Reserve got into the quantitative easing business in 2008.

But a Bloomberg headline this morning was so nonsensical I did a double take:

“A Doomsday Recession Mentality Is Keeping the S&P 500 Strong”

Sorry, come again?

Last I checked, recessions are bad.

And I’ve never associated the word “doomsday” with “strong.” The dictionary defines it as judgment day… a time of catastrophic destruction and death. The literal end of the world.

So, how is it that the strong performance of the stock market this month is due to a doomsday recession mentality?

It’s because, apparently, America’s largest companies have rediscovered the virtue of thrift… and expectations were already so bad that beating them was a cakewalk!

Per Bloomberg,

The anticipation of a recession may be contributing to the notable outperformance. Companies are shoring up their bottom line, cutting costs and stockpiling cash to stave off the impacts of an economic slowdown. Earnings revisions also dipped heading into the first quarter, leaving room for more upside potential.

It’s not just tech companies cutting back. Even presidential shadow candidate California Governor Gavin Newsom is getting in on the action. Newsom is cutting 10,000 state jobs and is proposing to cut $32.8 billion in spending. (You can watch this video for details on why we suspect his name might suddenly appear on the candidates list come August.)

Yes, the same Gavin Newsom who, for all intents and purposes, bankrupted the his state’s food services industry by raising the minimum wage to $20 per hour… and whose anti-growth policies have led to an exodus of both workers and businesses (California’s population is now smaller than it was in 2010).

Even that guy is finding it necessary to cut back.

I support a little belt tightening… particularly from a putz like Newsom. The Big Tech companies that dominate the stock market are notorious for allowing themselves to get bloated, so a focus on cost cutting isn’t a bad thing there either. And given the spike in credit card balances – and delinquencies – in recent years, rank-and-file Americans could stand a good consumption crash diet as well.

But there’s a funny thing about recessions. They tend to be a self-fulfilling prophecy.

When companies pull back on investment and consumers snap their wallets shut because of recession fears, their cutbacks in spending end up causing the very thing they feared. Every dollar not spent represents a dollar not earned by some business out there.

Speaking of consumers snapping their wallets shut, the University of Michigan consumer sentiment index just fell to a six-month low.

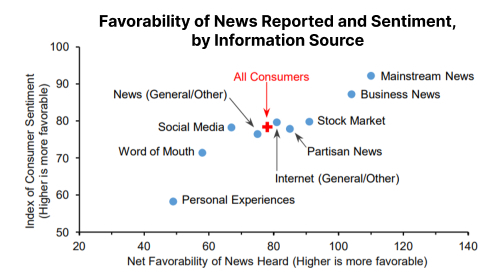

And here’s where it gets interesting. It’s not grumpy newsletter writers like me causing the dip in sentiment. The University of Michigan researchers graphed out the favorability of news heard against the sentiment index for each information source.

Take a look…

Survey director Joanne Hsu, explaining the results, writes:

The least favorable readings seen in the lower-left corner came from consumers referring to their own experiences and word-of-mouth as sources of information about the economy. At the other end of the spectrum in the upper right, those citing mainstream and business news have the most favorable levels of sentiment. Taken together, some consumers appear to have experiences (or know of others who have experiences) with the economy that diverge from the more positive portrayals noticed by consumers following mainstream or business news.

Consumer sentiment isn’t souring because the drumbeat of news is lousy…

Or because political ads are negative…

Or because social media is toxic (which it is!).

Consumer sentiment is dropping because the actual experience of the average American is getting worse.

Inflation isn’t receding nearly fast enough. Budgets are stretched. And now we see fears of recession setting in that might easily slide into reality.

Recessions are normal, and they’re a necessary part of the economic cycle. You could argue that the Federal Reserve’s insistence on tinkering with experimental monetary policy in an attempt to avoid recession is the entire reason we’re in this stagflationary mess.

Stagflation is an economic ghoul back from the 1970s to haunt us. It’s that worst of all worlds in which we get an economic slowdown and high inflation at the same time. It’s the malaise that made Jimmy Carter a one-term president.

There’s not a lot we can do to change it. But we can be prepared for it. That’s exactly what I’m helping our Freeport Investor members do this month. In the May edition, due out on Wednesday, I’ll be sharing with them our strategy to survive and thrive the stagflation taking hold. Make sure you’re on the list to get the latest issue. This video will explain why and how to do it.

In the meantime, hold on to your dollar hedges. The dollar may be on an express elevator to zero, but we can at least protect our purchasing power with gold, inflation-resistant industrial metals, and select cryptocurrencies.

To life, liberty, and the pursuit of wealth.

P.S. Investing in the right companies is just one way to survive stagflation. Another way is to be a creative, agile trader… which is something Freeport Society friend Jonathan Rose is a master at. Recently he shared his strategy and the indicator he uses to find profitable trades in any market and economic environment. Watch his Masters in Trading Summit now to make sure you’re in the best possible position to grow your wealth, whatever -flation may be around.