Editor’s Note: If you don’t know Eddie Pan… well, you should! So let me be the first to introduce you.

Eddie is our newest member in The Freeport Society, and he’ll be contributing regularly to The Freeport Navigator.

Money talks, and B.S. walks. That’s one of our core beliefs in this community, and following the money is what Eddie does best. He specializes in tracking the investment moves of some of the most powerful insiders on and off Wall Street (including our politicians).

And just where is the money flowing these days?

Well, it’s moving out of politically correct ESG stocks and – surprise, surprise! – into the shares of companies that actually make money. Eddie digs into this for his first Freeport Navigator contribution.

Please welcome Eddie to the Society… read and enjoy!

-Charles Sizemore

Warren Buffett has done it again!

He just slapped the environmental, social, and governance (ESG) crowd in the face again…

Before I explain how, let me introduce myself.

I’m Eddie Pan and I recently joined The Freeport Society as a contributor. I’m obsessed with tracking the investments of institutional investors, corporate insiders, and Washington politicians… something Charles recently wrote about.

So, how did Buffett spit in the face of the ESG cartel?

He just doubled down on his Occidental Petroleum (OXY) investment.

Berkshire Hathaway (BRK.A, B) first bought shares of Occidental during the third quarter of 2019 before completely selling out in Q2 2020.

However, in the first quarter of 2022, the Oracle of Omaha bought back a position in the energy company. To this day, he’s still buying shares.

Most recently, on June 17, Berkshire filed a Form 4 revealing a $175.98 million purchase of OXY stock. The hedge fund picked up a total of 2.94 million shares between June 13 and June 17.

Now Berkshire owns 255.28 million shares of OXY, which equates to a nearly 29% stake. It also owns 84,897 shares of the company’s Series A preferred stock and warrants to acquire 83.85 million shares.

Notably, this is Buffett’s ninth Occidental stock buy this month. He acquired 1.75 million shares worth $105.55 million between June 10 and June 12.

Berkshire owns more than 10% of Occidental’s shares, and so Buffett’s conglomerate is classified as an insider of the company.

While Buffett is a self-proclaimed liberal, he’s no fan of ESG investing, as Charles has discussed here before.

And this latest move is yet another in a growing rejection of ESG among investors of all sorts…

Rejecting the ESG Cartel

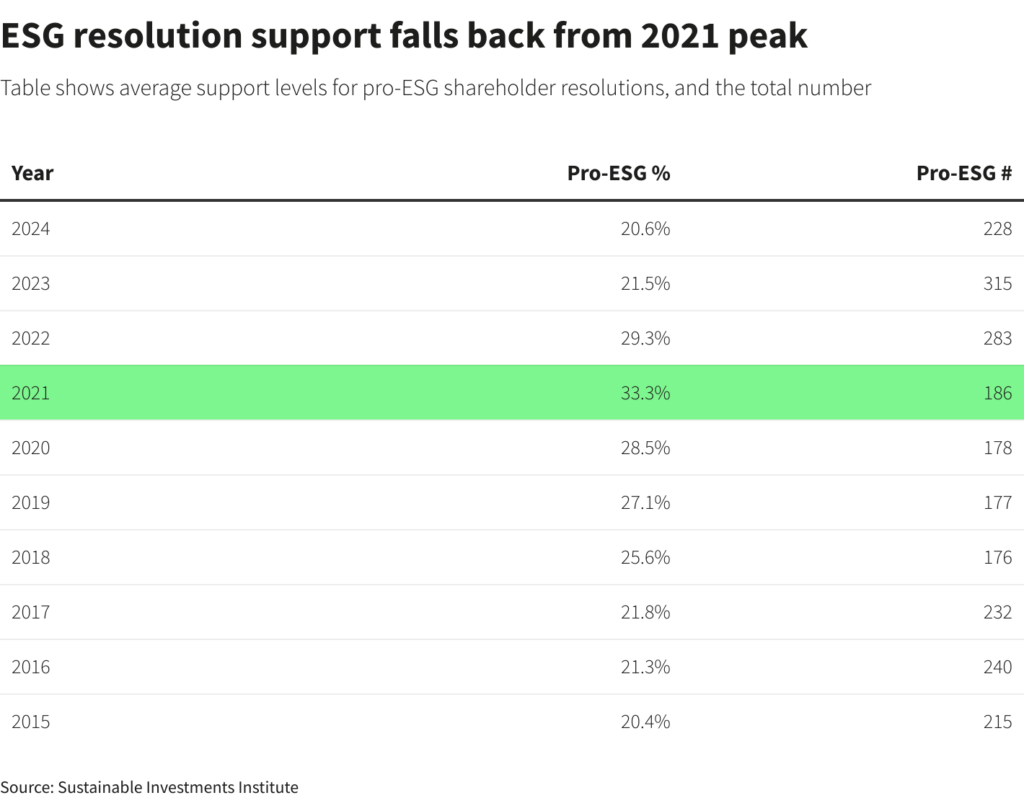

Support is waning, as you can see in this table from the Sustainable Investment Institute.

Here at The Freeport Society, we believe this shift away from ESG can’t come fast enough. Not only have the ESG crowd done enough damage to businesses’ bottom lines and investor portfolios, they’ve prevented the energy sector from receiving much needed investments.

After years of underinvestment (and lack of planning), exacerbated by major environmental, social, and governance (ESG) disincentives, we may be looking at a bona fide energy crisis ahead.

On June 1, OPEC+ committed to continuing its voluntary production cuts to keep oil prices high… yet the demand for oil and other fossil fuels is steadily increasing.

Despite the herculean efforts governments and environmentalists are making to usher in a world run purely on clean energy, as Charles, Tesla’s (TSLA) Elon Musk, and countless others have pointed out: To produce all that clean energy, we’re consuming even more dirty energy.

Adding to that energy burden is the exponentially increasing energy demands coming from the AI Revolution. For AI to take over the world in the next five years – as predicted in this video – it will need thousands of data centers.

Data centers that support AI are among the biggest energy consumers on the planet.

The Bottom Line…

Fossil fuel energy is still very much a part of our society, and that’s not changing anytime soon.

As such, companies involved in producing that energy are great investments… and Warren Buffett knows it.

The thing is, oil and gas companies are notoriously volatile… and the sector booms or busts at the whims of geopolitics, local politics, and do-gooders. So consider these investments longer term holds.

To grab the shorter term profits available within this space – and many others – you need a tool that lets you follow the money flow… so when insiders like Buffett make big stock purchases, you can follow suit.

Charles Sizemore and a leading fin-tech firm have developed such a system. Charles explains how it works in this video.

Companies are in the business of making money and rewarding their investors.

As investors, we’re in the business of making money by supporting those companies.

Using institutional and insider money flow to find the right investments just makes sense.

To life, liberty, and insider insights.